research report motilal oswal

Introduction

In the dynamic world of finance and investment, research reports play a pivotal role in guiding decisions and shaping strategies. One prominent player in this arena is Motilal Oswal, a leading financial services company in India, known for its insightful market analyses and comprehensive research reports. These documents serve not just as a repository of data but also as a compass for investors navigating the complexities of the stock market. By distilling vast amounts of information into clear and actionable insights, Motilal Oswal’s research reports empower investors to make informed choices in an ever-evolving economic landscape. This article delves into the significance of research reports in the financial sector, exploring how Motilal Oswal crafts its narratives to illuminate opportunities, mitigate risks, and ultimately enhance the investment journey for its clientele.

Exploring the Key Findings of Motilal Oswal Research Reports

The insights derived from Motilal Oswal’s research reports significantly empower investors with the knowledge they need to make informed decisions. Each report synthesizes large volumes of data into actionable intelligence, showcasing trends and projections that are pivotal in navigating the financial landscape. Key components include:

- Comprehensive Analysis: Reports delve into market dynamics, exploring both macroeconomic factors and sector-specific performance.

- Risk Assessment: Understanding potential pitfalls helps stakeholders balance their portfolios effectively.

- Outlook Projections: Detailed forecasts guide investment strategies based on expected market movements.

Moreover, the reports often feature comparative studies of different asset classes, highlighting where the best opportunities lie. For instance, Motilal Oswal frequently utilizes innovative data visualization techniques, making complex datasets easily digestible for all investors. A typical report may include:

| Asset Class | Projected Growth Rate | Recommended Action |

|---|---|---|

| Equities | 12% | Buy in dips |

| Bonds | 5% | Hold |

| Real Estate | 8% | Consider exposure |

Sectoral Insights: Unpacking Opportunities and Risks

As we delve into various sectors, the landscape reveals a tapestry of opportunities intertwined with risks, each demanding astute analysis. In sectors such as technology, advancements in artificial intelligence and machine learning continue to drive growth, fostering innovation and efficiency across multiple industries. However, the rapid pace of change also harbors uncertainties, such as regulatory scrutiny and cybersecurity threats, which could disrupt progress. Important sectors to watch include:

- Renewable Energy: Growing demand and supportive policies present significant growth potential.

- Healthcare: New technologies and increased focus on health management offer lucrative avenues.

- Financial Services: Fintech innovations are revolutionizing traditional banking, but associated risks like data breaches persist.

The consumer sector is equally dynamic, with e-commerce and digital payments gaining unprecedented relevance. However, as companies expand their online presence, they face the challenge of maintaining customer trust amidst rising data privacy concerns. A closer look at recent trends reveals the following noteworthy shifts:

| Trend | Opportunities | Risks |

|---|---|---|

| Shift to Online Shopping | Increased sales and customer reach | High competition and market saturation |

| Subscription Models | Predictable revenue streams | Churn rates and customer retention challenges |

| Personalization Technology | Enhanced customer experience | Over-reliance on data may lead to privacy issues |

Strategic Recommendations for Investors in the Current Market Landscape

In navigating the current market landscape, investors should adopt a multifaceted approach that aligns with their long-term financial objectives. A balanced portfolio remains vital, incorporating a mix of asset classes to mitigate risks and capitalize on potential growth areas. Key recommendations include:

- Allocate more to equities: Given the volatility of fixed-income securities, increasing exposure to dividend-paying stocks may provide better returns.

- Focus on sectors with resilience: Industries like technology and healthcare tend to perform well even during economic downturns.

- Diversify internationally: Investing in foreign markets can reduce domestic exposure and offer opportunities for growth.

Moreover, staying informed about macroeconomic indicators is essential for making well-timed investment decisions. Investors should monitor:

- Interest rates trends: Anticipating changes can guide asset allocation strategies.

- Inflation rates: Understanding inflation can aid in selecting investments that preserve purchasing power.

- Corporate earnings forecasts: Tracking these can provide insight into future stock performance.

| Asset Class | Current Recommendation |

|---|---|

| Equities | Increase exposure to growth stocks |

| Bonds | Limit allocation due to rising rates |

| Real Estate | Consider REITs for income generation |

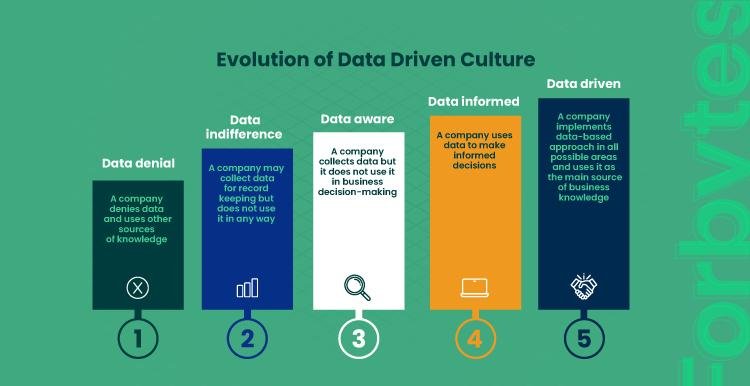

Navigating Future Trends: A Guide to Data-Driven Decision Making

html

In the rapidly evolving landscape of business, the ability to leverage data is becoming increasingly crucial for decision makers. Employing a data-driven approach empowers organizations to identify patterns, forecast trends, and enhance overall strategic planning. Key components of this strategy include:

- Identifying relevant data sources that influence business objectives.

- Utilizing advanced analytics to extract meaningful insights.

- Implementing decision-making frameworks that incorporate data findings.

Organizations looking to effectively navigate future trends must invest in tools that facilitate data collection and analysis. This includes adopting robust business intelligence (BI) tools that streamline the processing of large data sets and reporting mechanisms. Benefits of these technologies are significant:

- Rapid access to actionable insights.

- Improved accuracy in forecasting and strategy development.

- Enhanced collaboration across departments through unified data access.

To Wrap It Up

the research reports offered by Motilal Oswal provide a vital resource for investors aiming to navigate the complexities of the financial markets. With their comprehensive analyses, data-driven insights, and expert recommendations, these reports serve as a beacon of knowledge in a rapidly changing economic landscape. Whether you are a seasoned investor or a newcomer seeking to make informed decisions, tapping into the wealth of information presented by Motilal Oswal can empower your investment strategy and help you stay ahead of market trends. As you consider exploring their offerings further, remember that informed investing is not just about numbers; it’s about understanding the story behind them. Embrace the journey of financial growth and let the insights of Motilal Oswal guide your path to success.