research report for mba finance students

Unlocking the Future: A Comprehensive Guide to Research Reports for MBA Finance Students

In the ever-evolving landscape of finance, knowledge is not just power—it’s a prerequisite for success. For MBA finance students, the ability to conduct thorough research and present findings in a compelling manner is crucial. As they navigate complex concepts and data-driven insights, the creation of a research report becomes a pivotal component of their academic journey. This article delves into the intricacies of crafting effective research reports, providing a roadmap for students eager to refine their analytical skills and enhance their academic profiles. From selecting a relevant topic to interpreting data, we will explore the vital elements that transform a standard report into an engaging narrative that resonates with both peers and professors alike. Join us as we embark on this exploration, equipping aspiring finance leaders with the tools they need to excel in their scholarly pursuits.

Understanding the Foundations of Financial Research for MBA Students

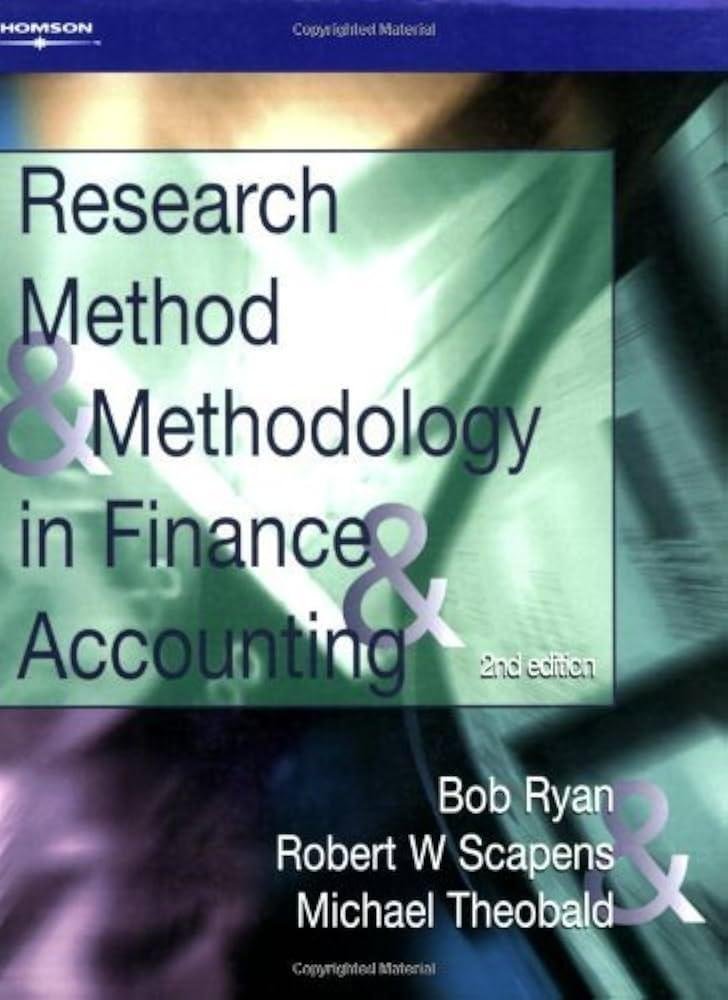

In the realm of financial research, MBA students are encouraged to develop a robust understanding of various methodologies and frameworks that underpin effective analysis. This includes familiarizing themselves with key publications and resources that contribute significantly to the field. Essential aspects of foundational financial research include:

- Understanding Financial Markets: Insights into stock markets, bond markets, and the foreign exchange market are crucial for comprehensive financial analysis.

- Research Methodologies: A grasp of qualitative and quantitative research methods ensures that students are equipped to analyze data accurately.

- Current Literature: Staying updated with journals such as the Journal of Financial Research allows students to engage with contemporary challenges and innovations in finance.

Moreover, the education process involves critical evaluation of existing research, which promotes the development of analytical skills necessary for effective decision-making. It is beneficial for students to engage with structured frameworks for their financial analyses to highlight their findings clearly. Here’s a simple structure that can be used as a reference:

| Key Elements | Description |

|---|---|

| Objective | Define the purpose of the research clearly. |

| Data Collection | Gather relevant financial data from credible sources. |

| Analysis | Apply appropriate financial models to interpret data. |

| Findings | Summarize key insights and implications for practice. |

Navigating Key Methodologies in Finance Research

In the realm of finance research, various methodologies serve as vital tools for MBA students aiming to delve into complex financial phenomena. Quantitative methods stand out for their ability to provide measurable data, often employing statistical techniques to analyze trends and forecast financial outcomes. These methodologies may include:

- Regression Analysis

- Time Series Forecasting

- Factor Models

- Risk Assessment Models

On the other hand, qualitative methods offer deeper insights into human behavior and market dynamics, focusing on the subjective aspects of finance. Techniques such as case studies, interviews, and content analysis allow students to explore the motivations and perceptions of financial decision-makers. Combining these approaches can lead to a more comprehensive understanding of the financial landscape. Below is a comparative table highlighting the key features of both methodologies:

| Methodology Type | Key Features | Common Applications |

|---|---|---|

| Quantitative | Data-driven, objective, statistical analysis | Market trend analysis, portfolio optimization |

| Qualitative | Subjective, exploratory, narrative analysis | Consumer behavior studies, financial decision-making |

Analyzing Market Trends: Insights for Academic and Practical Applications

Understanding market trends is crucial for both theoretical knowledge and practical application in finance. Analyzing historical data allows students to identify significant patterns that guide investment strategies. By participating in discussions on various types of trends, such as bullish, bearish, and ranging markets, students can better comprehend how economic indicators influence asset prices. A well-defined market trend can be determined by investigating the asset’s price direction over specific periods, enabling investors to predict potential future movements and capitalize on profitable opportunities [1].

Moreover, practical applications of trend analysis are of paramount importance. Finance students can leverage tools like interactive historical charts and economic indicators to conduct in-depth analyses across diverse markets. By utilizing high-quality resources, students can transform theoretical insights into actionable strategies. Creating a structured approach for analyzing trends can include:

- Identifying key market indicators

- Monitoring price movements

- Evaluating macroeconomic factors affecting the market

The integration of these elements not only enhances academic understanding but also prepares students for real-world trading scenarios, fostering a robust foundation for their future careers in finance [3].

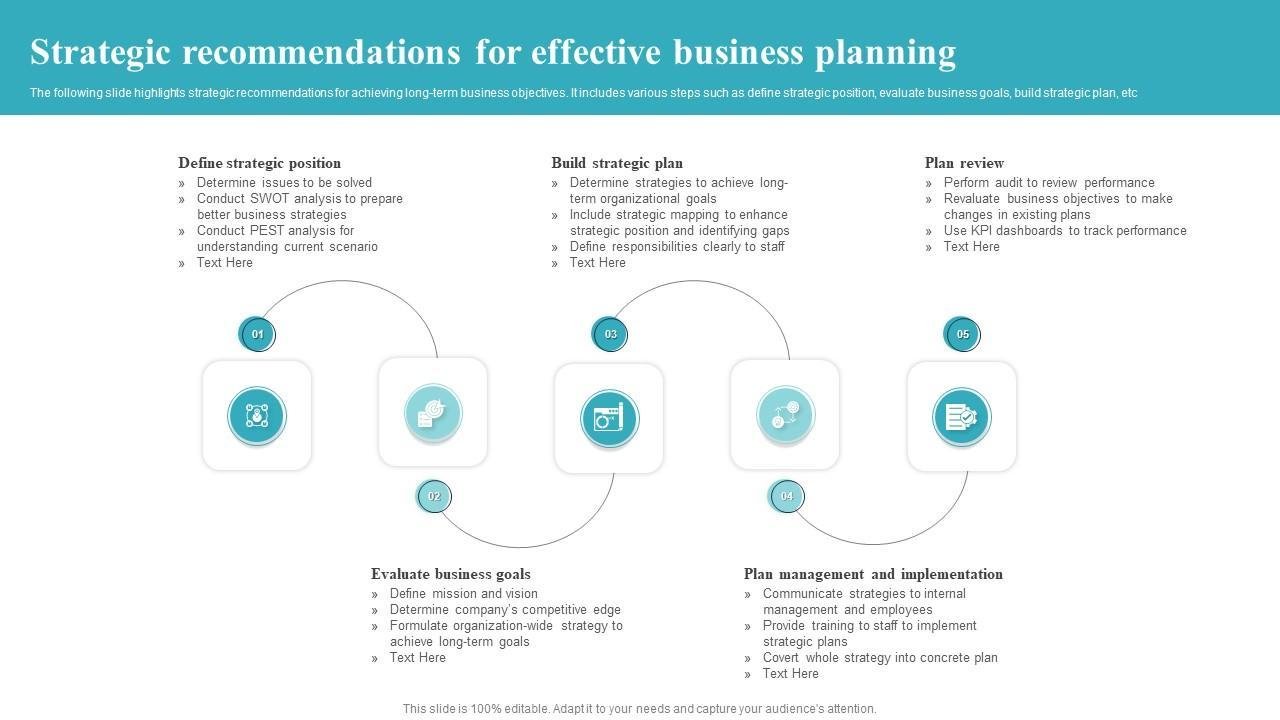

Strategic Recommendations for Enhancing Research Outcomes in Finance Education

To significantly enhance research outcomes in finance education, institutions should consider integrating real-world financial scenarios into their curriculum. This approach not only bridges the gap between theory and practice but also fosters critical thinking and problem-solving skills. Finance students benefit immensely when they are exposed to contemporary industry challenges through:

- Case Studies: Analyzing successful and failed financial strategies.

- Simulations: Engaging in market simulations that replicate live trading environments.

- Guest Lectures: Inviting industry professionals to share insights and experiences.

Additionally, collaborative research initiatives between academia and financial institutions can greatly elevate the quality of projects undertaken by students. Establishing partnerships encourages access to real data, enhancing the authenticity of research outputs. To facilitate this, institutions might implement strategic measures such as:

- Internship Programs: Allowing students to work directly with finance professionals.

- Research Grants: Providing funding for innovative student-led projects.

- Networking Events: Connecting students with alumni and industry experts for mentorship opportunities.

Insights and Conclusions

the journey of crafting a research report as an MBA finance student is not only a rite of passage but also a profound opportunity for intellectual growth and professional development. This process encourages a deep dive into the intricacies of financial theories and real-world applications, providing a unique lens through which to view the complexities of the economic landscape. By embracing the challenges and triumphs that come with this endeavor, students not only hone their analytical and problem-solving skills but also lay the groundwork for future success in their careers.

As you embark on this path, remember that the insights gained from your research will resonate far beyond the classroom. They will shape your perspectives, inform your decisions, and ultimately define your contribution to the financial world. So, roll up your sleeves, delve into the data, and embrace the transformative power of research—your future self will thank you.