research report finance

In the intricately woven tapestry of financial analysis, research reports stand as indispensable tools, illuminating the pathways of decision-making and strategic planning. These reports form the backbone of informed investment strategies, summarizing critical data and insights that fuel business growth and economic understanding. As stakeholders – from investors and corporate executives to policymakers – vie for clarity in complex financial landscapes, the role of a meticulously crafted research report becomes paramount. This article delves into the multifaceted nature of research reports in finance, exploring their composition, significance, and the methodologies that underpin them. By understanding how these documents are constructed, we can better appreciate their impact on financial markets and the broader economy, ultimately fostering a culture of informed financial stewardship.

Exploring the Landscape of Financial Research Reports

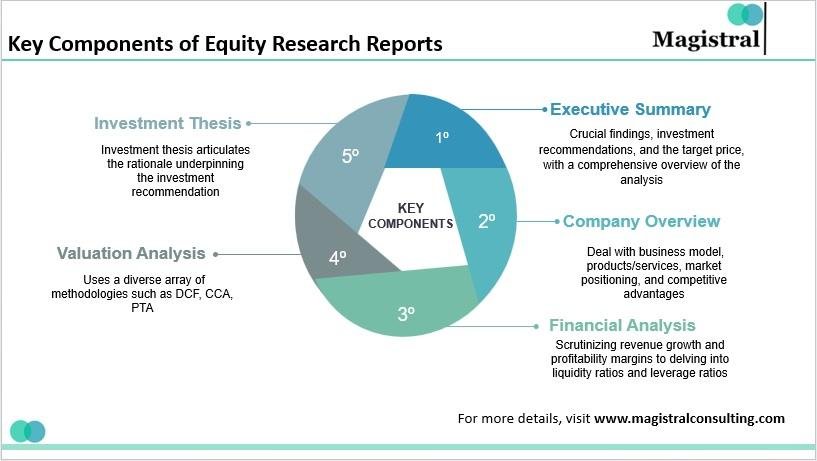

In the intricate world of finance, research reports serve as foundational tools for investors, policymakers, and academics alike. These documents provide in-depth analyses, forecasts, and strategic insights that encapsulate complex market trends. Exploration in this domain reveals several key elements that characterize effective financial research reports:

- Data-Driven Insights: High-quality reports leverage extensive datasets, utilizing statistical models to bolster their conclusions.

- Clarity and Precision: A well-structured report communicates findings in a clear and concise manner, making it accessible to a broad audience.

- Sector-Specific Focus: Tailoring reports to specific sectors unmasks unique trends that may otherwise remain obscured in aggregate data.

- Actionable Recommendations: The most impactful reports transcend mere analysis by offering strategic recommendations based on comprehensive research.

To illustrate the varying scope of financial research, consider the following comparative table that presents different types of reports and their primary focus:

| Report Type | Focus Area | Key Audience |

|---|---|---|

| Market Analysis Report | Current market conditions and forecasts | Investors, Analysts |

| Investment Research Report | Stock performance and recommendations | Portfolio Managers, Traders |

| Economic Outlook Report | Macroeconomic trends and impacts | Policymakers, Economists |

| Sector Report | Industry-specific analysis | Business Leaders, Analysts |

Analyzing Key Metrics for Enhanced Investment Decisions

Investors often rely on a variety of metrics to gauge the potential of their portfolios and make informed decisions. Key performance indicators (KPIs) such as return on investment (ROI), price-to-earnings (P/E) ratio, and asset allocation play a crucial role in this assessment. By analyzing these metrics, you can identify trends, evaluate asset performance, and benchmark against market averages. For instance, understanding the interplay between P/E ratios of comparable companies can bring to light overvalued or undervalued assets, further refining your investment strategy.

One of the most valuable tools in this analysis is the dashboard of financial ratios, which summarizes essential metrics in a single view. Below is a simple representation of how key metrics might be organized, assisting stakeholders in making decisive investment choices:

| Metric | Value | Industry Average |

|---|---|---|

| Return on Equity (ROE) | 15% | 12% |

| Debt to Equity Ratio | 0.5 | 0.8 |

| Current Ratio | 1.5 | 1.2 |

Utilizing data visualizations, such as bar graphs and trend lines, can also enhance understanding of these metrics over time, allowing for a clearer picture of growth or potential downturns in markets. Insights gleaned from these analyses are invaluable; they not only contribute to risk assessment but also enhance confidence levels in specific investment avenues, paving the way for strategic portfolio adjustments. As the financial market evolves, continuously revisiting and analyzing these key metrics remains essential for sustained success.

Innovative Approaches to Data Interpretation in Finance

The financial landscape is rapidly evolving, demanding fresh perspectives and innovative methodologies for data interpretation. Traditional statistical methods are giving way to advanced techniques that leverage machine learning and artificial intelligence, enabling analysts to uncover intricate patterns within vast datasets. These modern tools not only enhance accuracy but also provide real-time insights, leading to more informed decision-making. Key techniques include:

- Machine Learning Algorithms: Automated systems able to predict market trends.

- Sentiment Analysis: Assessing market emotions through social media and news.

- Big Data Analytics: Handling large datasets for comprehensive financial modeling.

Moreover, the integration of visualization techniques has transformed raw data into compelling narratives. By employing interactive dashboards and geo-spatial data mapping, finance professionals can communicate complex information succinctly. This enhances stakeholder engagement and promotes a clearer understanding of financial risks and opportunities. For example, consider the following table illustrating the impact of various data interpretation methods on investment returns:

| Method | Impact on Returns |

|---|---|

| Traditional Analysis | 5% growth |

| Machine Learning | 12% growth |

| Sentiment Analysis | 8% growth |

| Big Data Analytics | 15% growth |

Tailoring Research Strategies for Optimized Financial Performance

In the world of finance, a well-structured research strategy can be a game-changer, enhancing decision-making processes and propelling organizations toward success. To achieve optimal financial performance, companies must prioritize their research methodologies by focusing on the following elements:

- Data Quality: Ensure the data collected is reliable, accurate, and relevant to the financial context.

- Market Trends: Stay informed about emerging market trends that could affect financial outcomes and consumer behavior.

- Risk Assessment: Implement robust frameworks for identifying, analyzing, and mitigating financial risks.

- Technological Integration: Leverage technology and analytical tools to enhance data processing and insights generation.

Moreover, utilizing a flexible approach allows organizations to tailor their research strategies as market conditions evolve. Regularly updating the research framework should consider the following aspects:

| Aspect | Impact on Performance |

|---|---|

| Consumer Behavior Analysis | Informs product development and marketing strategies. |

| Competitor Benchmarking | Helps identify gaps and opportunities for market capture. |

| Regulatory Compliance Monitoring | Minimizes legal risks and enhances brand reputation. |

Wrapping Up

navigating the intricate landscape of research report finance is essential for both seasoned investors and curious newcomers alike. These reports are not just dry documents filled with numbers and jargon; they are vital narratives that tell the story of financial performance, trends, and projections. By critically engaging with these reports, stakeholders can make informed decisions that align with their financial goals and risk appetites. As we continue to advance in an increasingly data-driven world, the ability to decipher and leverage the insights found within research report finance will remain a cornerstone of successful investment strategies. Armed with the knowledge gained from this exploration, readers are encouraged to delve deeper into the world of finance, harnessing the power of research to illuminate their paths forward. After all, the future of finance is not merely about numbers; it is about thoughtful interpretation and strategic foresight.