nvidia equity research report pdf

In an era dominated by rapid technological advancement and digital transformation, companies like NVIDIA are at the forefront of innovation, driving change in industries ranging from gaming to artificial intelligence. As investors increasingly seek to navigate this dynamic landscape, the importance of comprehensive equity research reports cannot be overstated. Among these resources, the NVIDIA equity research report PDF stands out as a vital tool for stakeholders aiming to understand the company’s financial health, market position, and future growth potential. Through detailed analysis and insights, this report illuminates the underlying factors influencing NVIDIA’s performance and offers a lens through which investors can assess the opportunities and risks in a fast-evolving market. In this article, we will explore the key components of the NVIDIA equity research report PDF, its implications for investors, and how it serves as a crucial guide in making informed investment decisions.

Nvidias Market Position and Competitive Landscape

Nvidia has solidified its status as a leader in the semiconductor industry, primarily through its innovative graphics processing units (GPUs) and advancements in artificial intelligence (AI) technologies. The company’s ability to stay ahead of market trends has allowed it to capture a significant share in sectors such as gaming, data centers, and automotive industries. As the demand for AI-driven solutions continues to surge, Nvidia is well-positioned to capitalize on these emerging opportunities, offering products that surpass the capabilities of its competitors.

The competitive landscape for Nvidia features several key players, each vying for market share and technological supremacy. AMD, Intel, and Qualcomm represent formidable competition, pushing the boundaries in processing power and performance. Additionally, newer entrants, such as Graphcore and Horizon Robotics, are venturing into the GPU space, aiming to challenge Nvidia’s dominance. To illustrate this competitive dynamic, the table below highlights some critical factors influencing each company’s market stance:

| Company | Primary Focus | Market Share (%) |

|---|---|---|

| Nvidia | GPUs, AI Solutions | 80 |

| AMD | CPUs, GPUs | 15 |

| Intel | CPUs | 5 |

| Qualcomm | Mobile Processors | 3 |

| Others | Various | 2 |

Key Financial Metrics and Performance Analysis

NVIDIA’s financial performance in the latest fiscal period reveals a robust upward trajectory, underscoring its position as a leader in graphics processing technology. The following key metrics showcase the company’s impressive growth and operational efficiency:

- Revenue Growth: NVIDIA reported a year-over-year revenue increase of 61%, driven predominantly by a surge in demand for its GPUs across gaming, data center, and AI markets.

- Gross Margin: The company maintained a strong gross margin of 66.6%, reflecting its ability to control costs while maximizing IP value.

- Net Income: There was a substantial increase in net income to $3.04 billion, supported by higher sales volumes and strategic pricing adjustments.

In examining NVIDIA’s financial health through liquidity and profitability ratios, we find further affirmation of its resilience in a competitive market. Noteworthy ratios include:

| Metric | Value |

|---|---|

| Current Ratio | 4.2 |

| Return on Equity (ROE) | 50% |

| Debt-to-Equity Ratio | 0.3 |

NVIDIA’s financial metrics paint a picture of a company that not only thrives amidst challenges but is also strategically positioned for sustained growth and profitability in the coming years.

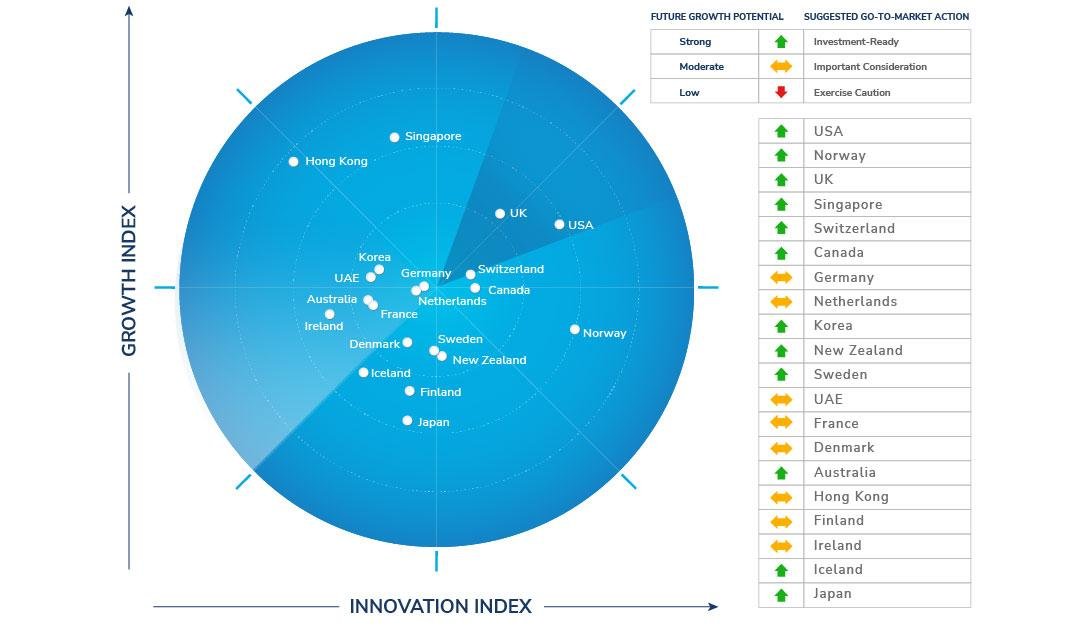

Future Growth Potential and Innovation Strategies

As NVIDIA continues to solidify its position as a frontrunner in the technology sector, its growth potential appears robust, driven by the expansion of artificial intelligence (AI) and machine learning markets. The company’s innovative GPUs are not only pivotal for gaming but are becoming increasingly essential across diverse applications such as data centers, autonomous vehicles, and healthcare. With a fortified focus on AI, NVIDIA is likely to leverage its technological expertise to develop more efficient architectures that cater to the evolving demands of intricate algorithms. This forward-thinking approach positions NVIDIA to capitalize on emerging trends and potentially unlock new revenue streams.

Moreover, NVIDIA’s commitment to research and development (R&D) is evident in its strategic investments aimed at enhancing product offerings. By fostering collaborative partnerships with leading tech firms and investing in startups focused on AI advancements, NVIDIA is set to spearhead innovations that can sustain competitive advantages. As part of its growth strategy, the company is likely to explore various avenues such as:

- Expanding product lines: Introducing next-gen graphics cards.

- Enhancing software ecosystems: Optimizing platforms for AI integration.

- Entering new markets: Targeting enterprise solutions for businesses.

In fostering a culture of continuous improvement and adaptability, NVIDIA aims to not only maintain but also enhance its stature in the tech landscape, paving the way for substantial long-term growth and innovation.

Investment Recommendations and Risk Considerations

html

When considering investment opportunities in Nvidia, it is crucial to evaluate the broader market trends and the company's strategic positioning within the tech industry. Short-term investments may benefit from Nvidia's ongoing advancements in artificial intelligence and data processing technologies, while long-term investors should focus on the company's ability to adapt to evolving market demands and competition. Key recommendations for potential investors include:

- Assessing Nvidia's quarterly earnings reports and growth forecasts.

- Monitoring industry trends, particularly in AI and graphic processing units (GPUs).

- Diversifying portfolios to mitigate sector-specific risks.

Risk considerations are equally important when investing in Nvidia shares. Market volatility can significantly impact stock prices, especially in tech sectors, where rapid innovation cycles can lead to unpredictable outcomes. Investors should be aware of the following risks:

- Regulatory challenges related to tech industry regulations.

- Competitive pressures from emerging technologies and rival companies.

- Economic factors that could influence demand for Nvidia's products.

Insights and Conclusions

the Nvidia equity research report is more than just a detailed analysis of a leading technology company; it serves as a vital resource for investors and analysts alike. By providing a comprehensive look at Nvidia’s market position, financial performance, and future outlook, the report equips stakeholders with the insights necessary to navigate the complexities of the semiconductor industry. As technology continues to evolve at a breakneck pace, understanding the nuances captured in such reports will be crucial for making informed investment decisions. With Nvidia’s persistent innovation and strategic endeavors, this equity research report not only reflects the company’s current standing but also hints at the exciting developments that lie ahead. Whether you’re a seasoned investor or a curious newcomer, delving into the intricacies of Nvidia’s performance may very well illuminate your path forward in a rapidly changing market landscape. Until next time, stay informed and empowered in your investment journey.