kotak research report

In an era where informed decision-making is paramount, the importance of reliable research and analysis has never been more critical. Enter the Kotak Research Report, a comprehensive resource designed to illuminate the intricacies of market dynamics, investment opportunities, and economic trends. With a reputation for meticulous scrutiny and data-driven insights, Kotak’s reports serve as a vital compass for investors, analysts, and policymakers alike. This article delves into the foundations of the Kotak Research Report, exploring its methodologies, key findings, and the overarching impact it wields in guiding financial strategies and fostering a deeper understanding of the evolving economic landscape. Whether you are a seasoned investor or a curious newcomer, join us as we unpack the significance of this influential resource and its role in shaping informed financial choices.

Insights into Market Trends: The Key Findings of the Kotak Research Report

The Kotak Research Report offers an enlightening look into the evolving landscape of various sectors, illustrating significant shifts in consumer behavior and economic patterns. Notable findings include:

- Increased Digital Adoption: A rising trend in online transactions and e-commerce engagements has been observed, with a notable surge in mobile wallet usage.

- Sustainability Focus: Companies are increasingly prioritizing sustainable practices, reflecting a broader consumer demand for eco-friendly products and services.

- Remote Work Continuation: Organizations are adapting to hybrid work models, indicating a long-term shift in workplace dynamics and employee expectations.

Furthermore, the report highlights the implications of these trends on market strategies and investment opportunities. Key points of interest reveal:

- Sector Diversification: Investors are encouraged to explore diversified portfolios, with particular emphasis on technology and renewable energy sectors.

- Emerging Markets: Growth potential in emerging markets presents an attractive avenue for future investments, spurred by urbanization and rising disposable incomes.

- Regulatory Changes: Ongoing policy shifts will likely impact operational frameworks, necessitating businesses to stay agile and informed.

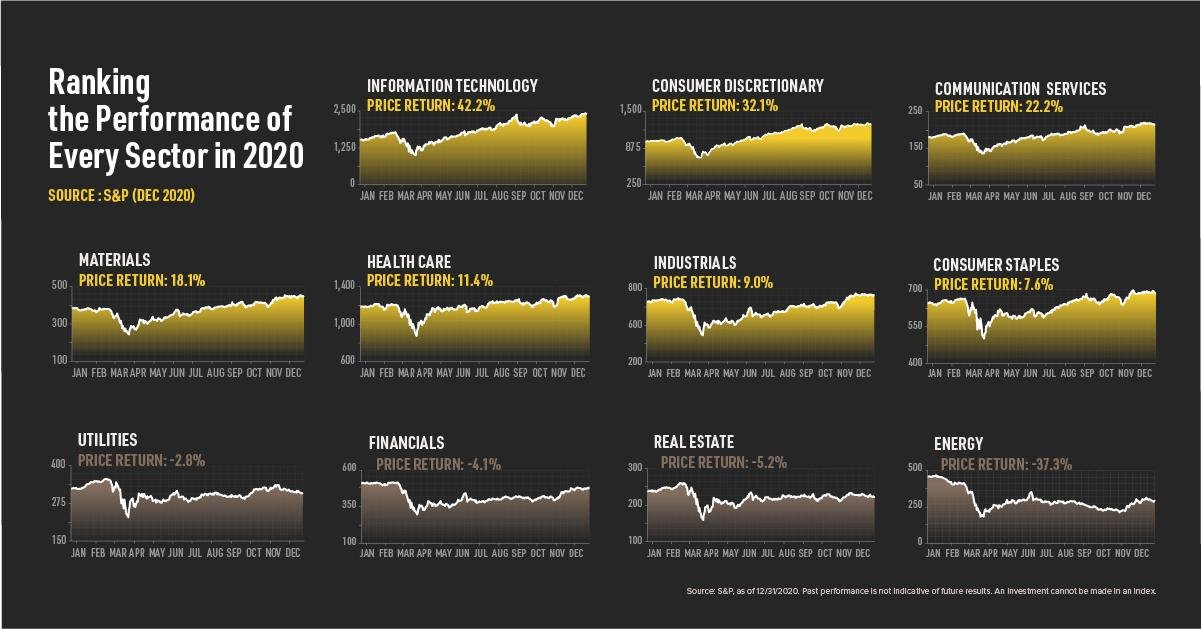

Navigating Sector Performance: A Deep Dive into Industry-Specific Analysis

In today’s dynamic marketplace, understanding sector performance is crucial for stakeholders aiming to make informed decisions. The latest insights from Kotak’s research report emphasize the importance of granular, industry-specific analysis to identify growth opportunities and potential pitfalls. By segmenting industries, this approach allows analysts to:n

- n

- Identify Key Drivers: Recognizing the factors that propel specific sectors forward.

- Assess Market Challenges: Understanding potential risks and obstacles within each industry.

- Gauge Competitive Landscapes: Evaluating the existing competition and market positioning.

n

n

n

n

nn

Moreover, leveraging quantitative data from such reports can provide a strong foundation for forecasting future trends. A comparative analysis of various sectors showcases differing performances, which could lead to strategic investment decisions. For instance, consider the following table summarizing sector performance metrics based on recent observations:

nn

| Sector | Q1 Growth (%) | Market Sentiment |

|---|---|---|

| Technology | 12.5 | Positive |

| Healthcare | 8.2 | Stable |

| Energy | -3.1 | Negative |

Strategic Recommendations: Leveraging Data for Informed Decision-Making

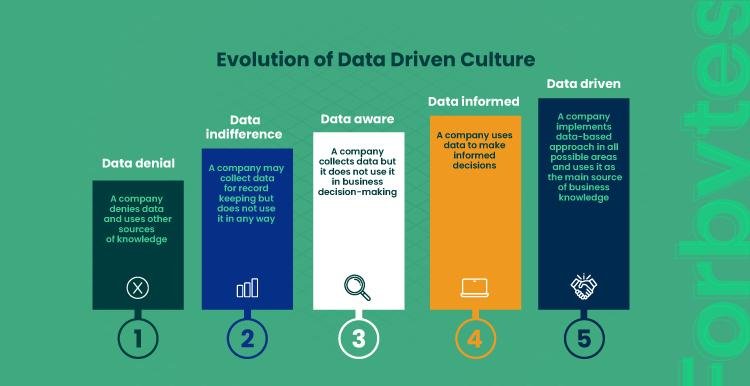

To enhance decision-making processes, organizations should prioritize the integration and analysis of data across all levels. By utilizing advanced analytics and real-time data monitoring, businesses can uncover trends, identify opportunities, and mitigate risks effectively. Key steps include:

- Establishing data governance: Create clear protocols for data collection, management, and usage to ensure data integrity.

- Investing in analytics tools: Equip teams with software that enables sophisticated data visualization and predictive analytics.

- Fostering a data-driven culture: Encourage team members to leverage data insights in their daily functions and decision-making processes.

Furthermore, collaboration between departments can amplify the effectiveness of data usage. Implementing cross-functional teams that focus on data-sharing initiatives can unearth insights that might otherwise be overlooked. A potential framework could include:

| Team | Data Focus Area | Benefit |

|---|---|---|

| Marketing | Consumer Behavior | Tailored Campaigns |

| Sales | Sales Trends | Optimized Resource Allocation |

| Operations | Supply Chain Analytics | Increased Efficiency |

By aligning efforts and utilizing shared insights, organizations can create comprehensive strategies that support informed decision-making, paving the way for sustained growth and innovation.

Future Outlook: Anticipating Market Shifts and Investment Opportunities

As we navigate through the complexities of the current economic landscape, various indicators suggest potential market shifts on the horizon. Investors should closely monitor factors such as changes in consumer behavior, advancements in technology, and evolving regulatory environments. The convergence of these elements is likely to unveil new avenues for growth, specifically in sectors such as renewable energy, healthcare technology, and e-commerce. With the ongoing digital transformation, companies that embrace innovative business models are poised to reap significant benefits.

Moreover, geographical shifts in investment patterns may present unique opportunities. Regions that previously lagged in economic development are gaining traction, driven by increased infrastructure investments and demographic shifts. Key considerations for investors include:

- Emerging Markets: Focus on regions with high growth potential.

- Sustainable Investments: Aligning portfolios with environmental goals.

- Industry Disruption: Identifying companies that can adapt and thrive amidst change.

| Sector | Investment Opportunities | Projected Growth (%) |

|---|---|---|

| Renewable Energy | Solar and Wind Projects | 15% |

| Healthcare Technology | Telemedicine Solutions | 20% |

| E-commerce | Last-Mile Delivery Services | 25% |

Key Takeaways

the Kotak Research Report serves as a vital beacon for investors and analysts navigating the often turbulent seas of financial markets. With its in-depth analyses, expert insights, and data-driven forecasts, it equips stakeholders with the tools necessary to make informed decisions. As we reflect on the trends and projections laid out in the report, it’s clear that understanding market dynamics is more crucial than ever. By staying informed and responsive to the findings within these pages, investors can not only safeguard their capital but also seize opportunities for growth in a changing economic landscape. We hope this overview has illuminated the importance of the Kotak Research Report, inviting you to delve deeper and leverage its findings in your own financial strategies. Stay curious, stay informed, and let the research guide your journey in the world of investment.