kotak mahindra bank equity research report

Unlocking Potential: An Insightful Look at Kotak Mahindra Bank’s Equity Research Report

In the ever-evolving landscape of Indian banking, Kotak Mahindra Bank stands as a beacon of innovation and resilience. As investors and analysts continuously seek to navigate the intricate financial markets, the latest equity research report on Kotak Mahindra Bank provides a comprehensive examination of the bank’s performance, prospects, and position within a competitive industry. This article delves into the key highlights of the report, shedding light on the bank’s strategies, growth trajectories, and the underlying factors that could influence its future. Join us as we unpack the insights and analyses that can empower stakeholders to make informed decisions in a dynamic economic environment.

Understanding Kotak Mahindra Banks Market Position and Growth Potential

html

Kotak Mahindra Bank has established itself as a formidable player in the Indian banking sector, marked by its robust growth trajectory and innovative approach to personal and commercial banking. The bank's strategic focus on digital transformation has enabled it to enhance customer experience and operational efficiency. This has not only attracted a growing customer base but also positioned the bank favorably in a competitive landscape. Key factors contributing to its market position include:

- Diverse Financial Products: Offering a wide range of savings accounts, personal loans, and credit card options.

- Strong Customer Base: Continuous growth in customer acquisition, supported by effective marketing strategies.

- Technological Advancements: Investment in state-of-the-art net banking facilities, making banking accessible and convenient.

The bank’s upward momentum is further supported by macroeconomic factors, such as the growing demand for retail and commercial banking services in India. With an eye on expanding its footprint, Kotak Mahindra Bank is poised to tap into emerging markets and digital ecosystems. This expansion is underpinned by:

- Increased Lending Capacity: Enhanced capital adequacy ratios allowing for more aggressive lending.

- Focus on Financial Inclusion: Initiatives aimed at reaching unbanked segments of the population.

- Agile Risk Management: Ability to navigate economic uncertainties effectively.

Year

Net Profit (in INR Crores)

Growth Rate (%)

2021

3,419

19.2

2022

4,262

24.6

2023

5,189

21.7

Key Financial Ratios and Their Implications for Investors

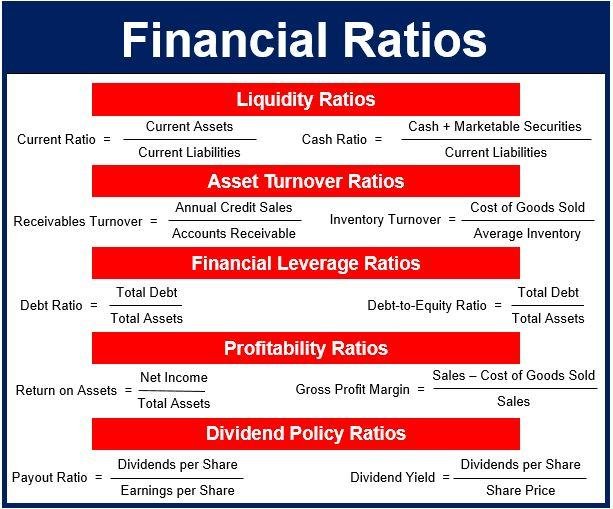

Understanding financial ratios is essential for investors seeking to evaluate the performance and stability of Kotak Mahindra Bank. Several key ratios can help investors gauge the bank’s health, including:

- Return on Equity (ROE): This ratio indicates how efficiently the bank is using shareholders’ equity to generate profits. A higher ROE suggests strong management performance.

- Debt-to-Equity (D/E): This ratio measures the proportion of debt financing relative to equity. A lower D/E ratio can indicate a more financially stable institution, less exposed to market fluctuations.

- Price-to-Earnings (P/E): This ratio reflects investors’ expectations regarding future earnings growth. A high P/E may suggest that the stock is overvalued, or investors anticipate high growth rates.

Additionally, liquidity ratios such as the Current Ratio and Quick Ratio shed light on the bank’s ability to meet short-term obligations. Following is a simplified overview of key ratios:

| Financial Ratio | Implication |

|---|---|

| Return on Equity (ROE) | High indicates effective management. |

| Debt-to-Equity (D/E) | Low suggests stable finances. |

| Price-to-Earnings (P/E) | High may signal growth expectations. |

| Current Ratio | Indicates short-term financial health. |

| Quick Ratio | Assesses immediate liquidity. |

Sector Analysis: How Kotak Mahindra Bank Stands Against Competitors

When evaluating Kotak Mahindra Bank’s position within the competitive landscape of the Indian banking sector, it’s essential to consider several key performance indicators. The bank has consistently demonstrated strong fundamentals, maintaining a robust capital adequacy ratio that exceeds regulatory requirements. This stability provides a significant buffer against market fluctuations, enabling Kotak to sustain growth in both retail and corporate banking segments. Notably, the bank’s net interest margin is competitive, allowing it to efficiently manage operational costs while maximizing returns for its stakeholders.

In comparison to its peers, Kotak Mahindra Bank exhibits remarkable resilience and innovation, especially in the digital banking space. The growing emphasis on technology-driven services aligns with consumer preferences for convenient banking solutions. Key differentiators include:

- Extensive digital offerings: Advanced mobile banking applications and online platforms that enhance customer experience.

- Strong asset quality: Low non-performing assets (NPAs) compared to industry averages, highlighting prudent lending practices.

- Diverse product portfolio: Comprehensive financial services ranging from personal loans to wealth management, catering to a broad customer base.

| Bank | Net Interest Margin (%) | Capital Adequacy Ratio (%) | NPA Ratio (%) |

|---|---|---|---|

| Kotak Mahindra Bank | 4.5 | 18.5 | 1.8 |

| HDFC Bank | 4.4 | 18.1 | 1.3 |

| ICICI Bank | 3.9 | 16.9 | 3.2 |

Investment Recommendations: Strategies for Capitalizing on Kotak Mahindra Banks Opportunities

Investors looking to capitalize on the growth opportunities presented by Kotak Mahindra Bank (KMB) should consider diversifying their portfolios and focusing on key strategic areas that can enhance returns. KMB has demonstrated strong fundamentals, driven by a robust retail banking sector and innovative digital banking solutions that have attracted a younger demographic. The bank’s continuous effort to expand its product offerings—ranging from wealth management to insurance—enables it to cater to a diverse client base. Some recommended strategies include:

- Engaging in regular performance reviews: Monitor quarterly earnings and key performance indicators.

- Diversification across segments: Invest in multiple KMB services to mitigate risk.

- Capitalizing on digital transformation: Focus on tech-driven financial products that appeal to millennials.

Furthermore, with the consistent growth in the Indian banking market, KMB’s strategic initiatives to enhance the customer experience through technology make it a compelling long-term investment. It is essential for investors to keep an eye on regulatory trends and macroeconomic factors affecting the banking sector, including interest rate changes and monetary policies, which can significantly impact KMB’s profitability. A potential investment roadmap could feature:

- Long-term growth stocks: Target shares with a strong historical performance.

- Dividend reinvestment schemes: Utilize dividends to buy more shares, compounding growth.

- Research and analytics: Leverage analytical tools for better investment decisions.

Wrapping Up

the Kotak Mahindra Bank equity research report serves as a comprehensive lens through which investors can gauge the bank’s current performance and future potential. With a blend of quantitative analysis and qualitative insights, it highlights the bank’s strategic initiatives, market positioning, and resilience in navigating economic fluctuations. As we move forward, the insights gleaned from this report will prove invaluable for stakeholders looking to make informed decisions in the dynamic landscape of banking and finance. Whether you’re a seasoned investor or a newcomer to the market, understanding the nuances of Kotak Mahindra Bank’s operations will empower you to chart a informed path in your investment journey. Ultimately, staying abreast of such reports not only enriches your financial knowledge but also equips you to tackle the complexities of the investment world with confidence.