knight frank research report

In the ever-evolving landscape of the global property market, data-driven insights play an indispensable role in shaping strategies and forecasting trends. Enter the Knight Frank Research Report, a beacon for investors, developers, and industry professionals alike. Renowned for its meticulous analysis and comprehensive coverage, this report unravels the complex tapestry of real estate dynamics, offering a deep dive into market movements, emerging opportunities, and potential challenges. As we explore the latest findings, we unveil the nuances that not only define current market conditions but also pave the way for the future of property investment and urban development. Join us as we delve into the key themes and critical insights presented in this esteemed report, illuminating the path forward in a realm where knowledge is power.

Emerging Trends in Global Real Estate Markets

As the global real estate landscape continues to evolve, several trends are emerging that reflect shifts in market dynamics and investor priorities. Today, sustainability has become a cornerstone of property valuation, with many investors prioritizing eco-friendly buildings and developments. Urban areas are seeing a surge in demand for mixed-use spaces that combine residential, commercial, and recreational facilities, creating vibrant communities designed for modern living. Additionally, the rise of remote work has catalyzed interest in suburban and rural properties, where buyers are seeking larger spaces and lower prices compared to urban centers.

Technology also plays a critical role in shaping the future of real estate. The adoption of proptech innovations is transforming property management, enabling enhanced tenant experiences through smart building solutions and efficient maintenance systems. Virtual tours and online transactions are becoming the norm, increasing accessibility for potential buyers and renters. Moreover, as global economic uncertainties and geopolitical events influence investment patterns, international buyers are exploring diverse markets, diversifying their portfolios and embracing opportunities that offer potential for high returns. In this increasingly connected world, understanding these trends is essential for stakeholders aiming to navigate the complexities of the real estate market successfully.

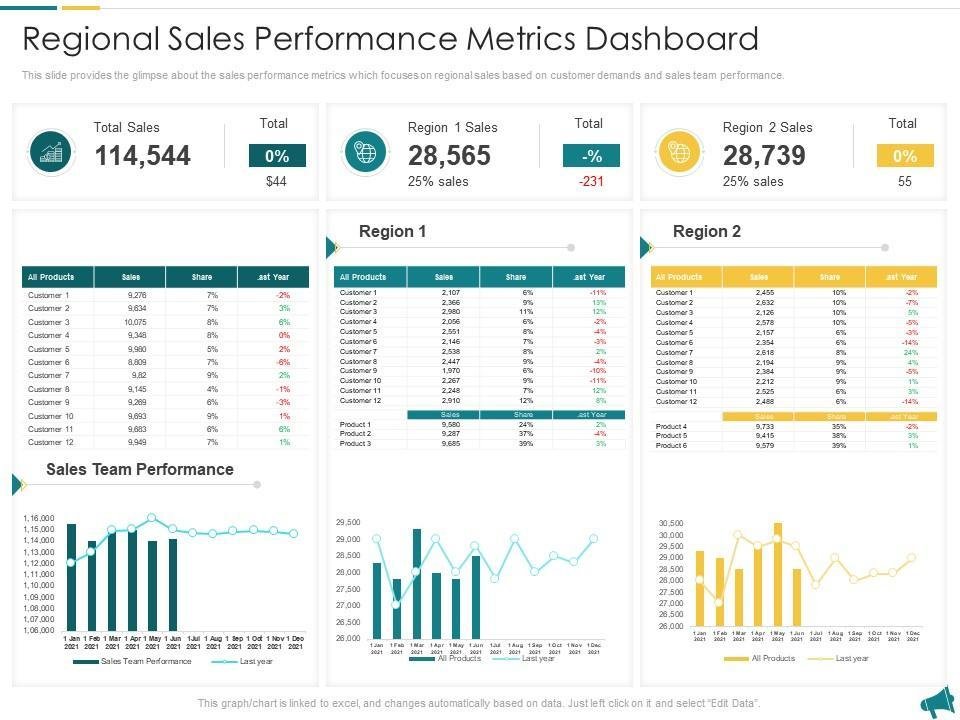

Deep Dive into Regional Performance Metrics

The analysis of regional performance metrics reveals significant variations that warrant attention from investors and stakeholders alike. By dissecting trends in key economic indicators, one can gauge the vibrancy of different markets. Metrics such as GDP growth, unemployment rates, and commercial property yields can be pivotal in understanding where investment opportunities lie. Investors should particularly focus on:

- Population Growth: Indicates potential demand for housing and commercial space.

- Infrastructure Development: Enhancements can elevate property values and attract businesses.

- Industry Diversification: A region with varied industries is likely to be more resilient to economic shocks.

To illustrate these performance metrics more clearly, consider the following comparative table summarizing key indicators across selected regions:

| Region | GDP Growth (%) | Unemployment Rate (%) | Commercial Property Yield (%) |

|---|---|---|---|

| Region A | 2.5 | 4.0 | 6.5 |

| Region B | 3.7 | 3.2 | 5.8 |

| Region C | 1.8 | 5.5 | 7.2 |

By closely monitoring these performance metrics and understanding their implications, stakeholders can make informed decisions that align with the evolving economic landscape. Each region’s unique characteristics contribute to its overall performance, making it crucial to look beyond aggregated statistics to gain a true insight into potential investments.

Strategic Recommendations for Investors and Stakeholders

In an ever-evolving market landscape, stakeholders should prioritize a multifaceted approach to investment. Diversification remains critical; investors are encouraged to allocate resources across various sectors, reducing the risks associated with market volatility. Moreover, regional analysis should drive investment decisions, with a focus on emerging markets that exhibit strong growth potential. Identifying sectors poised for significant growth, such as technology, healthcare, and renewable energy, coupled with a comprehensive understanding of local economic indicators, can lead to substantial returns.

Investors must also leverage strategic partnerships to enhance market penetration. By engaging with local firms, stakeholders can benefit from shared expertise and insights while mitigating risks associated with unfamiliar markets. Sustainability should be at the forefront of any investment strategy, with an emphasis on companies demonstrating responsible practices. Implementing a robust due diligence process to assess both financial and non-financial performance will be crucial. Continuous monitoring of market trends and adapting investment strategies accordingly will not only safeguard assets but will also position investors favorably for long-term success.

Navigating Challenges and Opportunities in 2024 and Beyond

As we venture into 2024, the landscape is marked by a unique blend of challenges and opportunities that demand innovative approaches from businesses and individuals alike. Key factors influencing this shift include:

- Technological Advancements: The rapid development of AI and automation can streamline operations but requires adaptation and reskilling of the workforce.

- Environmental Sustainability: Companies are increasingly pressured to adopt eco-friendly practices which present both a challenge and a chance to differentiate in a crowded market.

- Economic Shifts: Fluctuations in economic indicators are leading to a reassessment of investment strategies, emphasizing the need for agility in decision-making.

It is crucial to leverage these developments effectively. Organizations can enhance their strategic position by focusing on:

- Embracing Innovation: Integrating cutting-edge technologies to improve efficiency and customer engagement.

- Diversifying Offerings: Expanding product lines or services to meet emerging consumer needs in a post-pandemic world.

- Strengthening Resilience: Building robust frameworks to withstand economic uncertainties and market fluctuations.

| Opportunity | Challenge | Potential Solution |

|---|---|---|

| AI Integration | Workforce Displacement | Comprehensive Training Programs |

| Sustainable Practices | Implementation Costs | Long-term Cost Savings Analysis |

| Diverse Markets | Increased Competition | Unique Value Proposition |

Closing Remarks

the Knight Frank Research Report serves as a vital compass for navigating the complexities of the ever-evolving real estate landscape. By juxtaposing data with insightful analysis, the report not only illuminates the current market trends but also offers a glimpse into the future, empowering investors, developers, and policymakers to make informed decisions. As we stand at the crossroads of opportunity and uncertainty, embracing the findings of this report can help stakeholders chart a path toward sustainable growth and success. Whether you are a seasoned professional or a newcomer to the market, the insights gleaned from Knight Frank’s meticulous research can be your guiding star in the intricate world of property investment and development. As we turn the page on this chapter of real estate analysis, may we continue to foster a dialogue around data-driven strategies and innovative solutions that will shape the markets of tomorrow.