hindenburg research nikola report pdf

In the complex and often turbulent world of finance, few narratives have captured attention quite like the story of Nikola Corporation—a company that sought to revolutionize the transportation industry with bold promises of innovative electric and hydrogen-powered vehicles. However, lurking behind the sleek exterior of groundbreaking technology and ambitious visions was the critical eye of Hindenburg Research, a firm known for its investigative prowess in highlighting potential discrepancies within companies. As they unveiled their detailed report on Nikola, the ripples of their findings stirred not only the market but also the perceptions of investors and industry analysts alike. In this article, we delve into the intricacies of the Hindenburg Research Nikola report, exploring its key revelations, implications for the future of the company, and the broader conversation it ignites about transparency and accountability in the ever-evolving landscape of corporate America. Join us as we dissect the contents of this pivotal document, shedding light on its significance in a narrative filled with ambition, skepticism, and the quest for integrity in business practices.

Understanding the Hindenburg Research Report on Nikola

The Hindenburg Research report critically evaluates Nikola Corporation, addressing potential discrepancies in the company’s business practices and product capabilities. It highlights several key allegations that have sparked widespread debate and scrutiny within the financial community. Some of the main points raised include:

- Overstated vehicle capabilities: The report claims that Nikola may have embellished the functionalities of its hydrogen fuel cell and electric vehicles.

- Misleading partnerships: Allegations suggest that some strategic collaborations were overstated, leading to questions about the legitimacy of Nikola’s business model.

- Financial transparency issues: The report emphasizes concerns regarding the accuracy of Nikola’s financial disclosures and projections.

To further illustrate the gravity of these claims, the table below summarizes the key components of the allegations laid out by Hindenburg Research:

| Allegation | Description |

|---|---|

| Overstated Technology | Claims of inflated capabilities of Nikola’s vehicles compared to reality. |

| Partnership Integrity | Concerns about the authenticity and impact of reported partnerships. |

| Financial Misrepresentation | Accusations of lack of proper transparency in financial matters. |

This critical analysis offers investors and stakeholders a clearer understanding of the potential risks associated with Nikola Corporation’s operations and the implications for its future viability in the competitive automotive industry.

Key Allegations and Financial Implications Explored

The Hindenburg Research report on Nikola Corporation has raised significant questions about the company’s business practices and financial reporting. Among the core allegations are that Nikola misled investors about its technology and operational capabilities. Specific accusations include:

- Overstating vehicle production capabilities: The report claims that Nikola presented inflated figures regarding its ability to manufacture and deliver trucks.

- Misrepresentation of critical technology: The findings suggest that some key technological advancements were exaggerated or misrepresented.

- Concerns over partnerships: The nature and progression of partnerships with other companies have also been scrutinized for transparency.

These allegations have not only tarnished Nikola’s reputation but have also had serious financial implications. Following the release of the report, Nikola’s stock price experienced significant volatility, resulting in a considerable loss of market capitalization. The impact is evident in the following table that illustrates the stock’s performance before and after the report’s release:

| Date | Stock Price (USD) |

|---|---|

| Before Report | $35.00 |

| Day of Report | $20.00 |

| One Week Later | $15.00 |

This decline is accompanied by investor concerns about potential legal ramifications and a potential shift in strategic direction, creating a cloudy outlook for Nikola’s future.

Analyzing the Impact on Shareholder Sentiment and Market Trends

The recent reports by Hindenburg Research have significantly influenced shareholder sentiment and market trends, particularly for companies scrutinized by activist investors. As they unveil serious allegations, such as accounting fraud and stock manipulation linked to prominent figures in the business world like Gautam Adani, shareholders often find themselves in a precarious position. These revelations typically lead to a chain reaction that prompts a reassessment of investment strategies. Investors are particularly concerned about:

- Management integrity: Allegations can tarnish the reputation of leadership, leading to doubts about their ability to steer the company effectively.

- Market volatility: Such reports often trigger immediate sell-offs, impacting share prices and overall market perception.

- Regulatory implications: Heightened scrutiny from market regulators can create an uncertain operational environment.

Furthermore, the psychological impact on the stock market can be profound. The apprehension surrounding a company’s future stability can dilute investor confidence, pushing stock prices further down. Observing how swiftly the market reacts to news can provide a gauge of overall investor sentiment. Key indicators of sentiment shift include:

- Trading volumes: Increased trading can signal heightened investor anxiety and speculation.

- Long/Short interest ratios: A rise in short positions often indicates a bearish outlook among investors.

- Analyst downgrades: Recommendations from analysts tend to reinforce negative sentiment and exacerbate selling pressure.

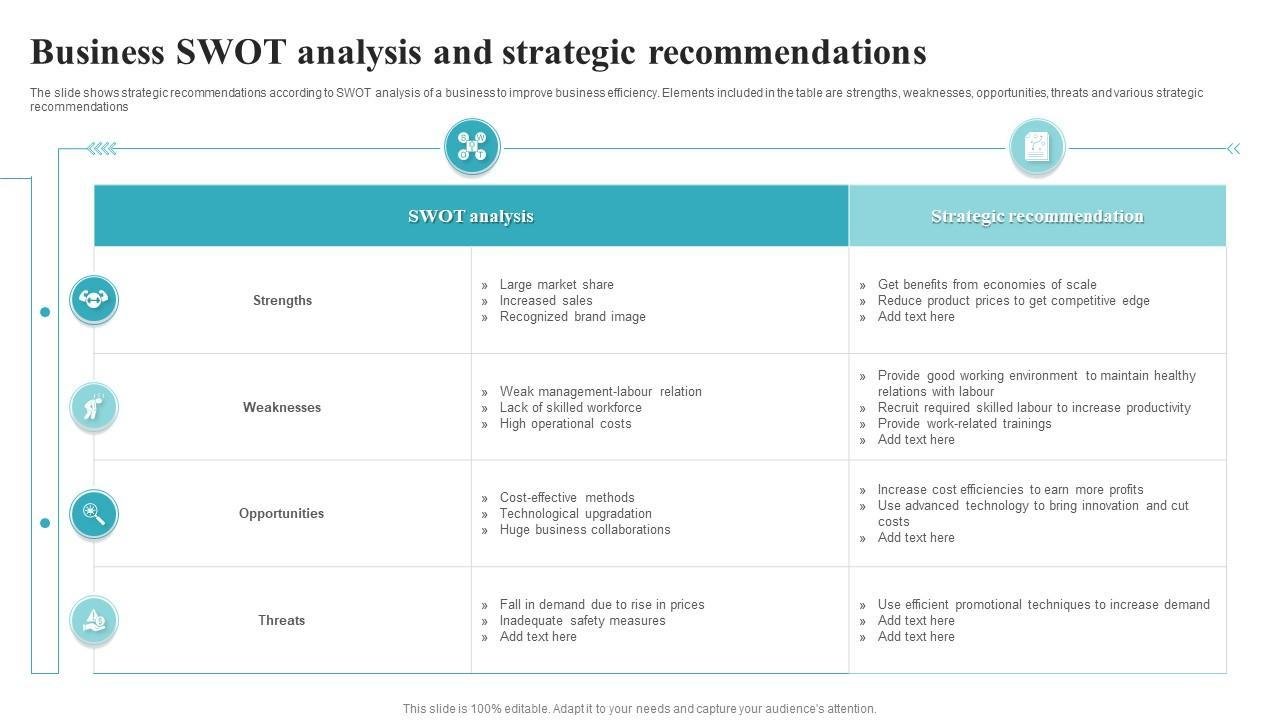

Strategic Recommendations for Navigating the Aftermath

In light of recent developments surrounding the Nikola report from Hindenburg Research, key stakeholders must adopt a proactive approach. Utilizing crisis management strategies will be essential for organizations affected by the findings. Emphasizing transparency in communications can foster trust and mitigate damage to reputation. It’s crucial to focus on the following aspects:

- Stakeholder Engagement: Maintain open lines of communication with investors, employees, and customers to address concerns and reinforce commitment.

- Reassessment of Strategy: Conduct a thorough review of business practices and align them with ethical standards to enhance credibility.

- Legal Consultation: Seek legal advice to navigate potential repercussions and formulate a strategic response to any claims made in the report.

Moreover, organizations should prioritize investing in robust compliance mechanisms to prevent future controversies. By fostering a culture of accountability, companies can create resilience amid adversity. Consider implementing the following measures:

| Measure | Action Steps |

|---|---|

| Enhanced Training | Implement regular workshops focusing on ethics and compliance. |

| Regular Audits | Conduct bi-annual audits to identify and rectify potential issues. |

| Public Relations Campaign | Launch initiatives that highlight corporate social responsibility efforts. |

In Retrospect

the Hindenburg Research report on Nikola has sparked a significant discussion within the investment community, shining a light on the complexities of the electric vehicle industry and the promises made by emerging companies. While the revelations in the report raise questions about transparency and corporate integrity, they also serve as a reminder of the necessity for caution and diligence in navigating the rapidly evolving landscape of innovative technologies. As investors and stakeholders continue to dissect the intricate details of these findings, it’s essential to approach the future of Nikola—and indeed, the broader EV sector—with an informed perspective. Whether viewed as a cautionary tale or a stepping stone to reform, the implications of the Hindenburg report will undoubtedly resonate for some time, prompting both reflection and action in the relentless pursuit of sustainable progress. As we close this chapter, one thing remains clear: the quest for truth in the world of finance is as crucial as ever.