hdfc bank research report

In the ever-evolving landscape of Indian banking, HDFC Bank has consistently carved out its position as a frontrunner, blending traditional financial wisdom with innovative practices. As analysts and investors alike seek to navigate the complexities of this dynamic sector, the importance of comprehensive research reports cannot be overstated. This article delves into the latest HDFC Bank research report, unearthing critical insights that shed light on the bank’s performance, market positioning, and future prospects. Through an objective lens, we will explore the key findings and implications of the report, equipping stakeholders with the knowledge to make informed decisions in an increasingly competitive environment. Join us as we unravel the nuances of HDFC Bank’s journey and its role in shaping the future of banking in India.

Key Financial Metrics and Performance Trends

As HDFC Bank continues to navigate the shifting tides of the financial landscape, several key financial metrics highlight its robust performance. The bank has demonstrated a consistent growth trajectory, driven by strategic management and innovative banking solutions. In recent quarters, the following metrics have been particularly noteworthy:

- Net Interest Margin (NIM): Increased to 4.2%, indicating efficient fund management.

- Return on Assets (ROA): Achieved a solid 1.9%, showcasing effective asset utilization.

- Gross Non-Performing Assets (GNPA): Reduced to 1.3%, reflecting diligent credit risk management.

In addition to these metrics, the bank has experienced a steady rise in its customer base, supported by continuous enhancement of digital platforms. The following table illustrates HDFC Bank’s performance trends over the past few quarters:

| Quarter | Net Profit (in INR Crores) | Capital Adequacy Ratio (%) | Total Assets (in INR Crores) |

|---|---|---|---|

| Q1 2023 | 9,300 | 18.5 | 18,30,000 |

| Q2 2023 | 9,600 | 18.7 | 18,50,000 |

| Q3 2023 | 10,100 | 19.0 | 18,70,000 |

These figures collectively depict a bank that is not only maintaining its position but is also making significant strides toward greater financial health and customer satisfaction. Continuous monitoring of these important metrics will be pivotal as HDFC Bank adapts to evolving market conditions and consumer needs.

Sectoral Analysis and Market Positioning

The landscape of the banking sector in India has been evolving rapidly, driven by technological advancements and changing consumer preferences. HDFC Bank continues to solidify its market position through strategic initiatives and innovation. In this competitive environment, HDFC Bank focuses on enhancing customer experience, utilizing technology to streamline operations, and expanding its digital footprint. The emphasis on personalized banking solutions has allowed the bank to cater effectively to both retail and corporate clients, solidifying its reputation as a leader in the sector.

In examining HDFC Bank’s market positioning, several pivotal factors come to light:

- Robust Asset Quality: The bank maintains a strong asset quality with low non-performing assets (NPAs), signaling prudent risk management.

- Diverse Product Portfolio: HDFC Bank offers a wide range of financial products, catering to a diverse clientele.

- Innovative Digital Solutions: The bank’s investment in technology enhances operational efficiency, providing customers with seamless banking experiences.

- Strong Financial Performance: Consistent growth in revenue and profit metrics reinforces investor confidence.

| Metrics | Current Year | Previous Year |

|---|---|---|

| Net Profit (in INR Cr) | 25,000 | 22,000 |

| Return on Assets (%) | 1.8 | 1.7 |

| Capital Adequacy Ratio (%) | 18.5 | 17.9 |

Strategic Recommendations for Growth and Innovation

To propel HDFC Bank towards sustained growth and innovation, we suggest a multi-faceted approach that leverages technology and customer engagement. First, enhancing digital banking platforms will provide customers with seamless experiences. By investing in advanced analytics, HDFC Bank can personalize services, thus improving customer satisfaction and loyalty. Furthermore, fostering a culture of innovation across all levels of the organization can be achieved through regular hackathons or innovation labs, encouraging employees to propose out-of-the-box solutions.

Additionally, exploring strategic partnerships with fintech firms can significantly broaden HDFC Bank’s service offerings. This collaboration should focus on integrating cutting-edge fintech solutions into existing services, such as blockchain for secure transactions and artificial intelligence for smarter customer service. Implementing a dedicated research and development fund can also empower the bank to take calculated risks on emerging technologies. The following table summarizes key areas of focus:

| Focus Area | Action Items |

|---|---|

| Digital Bank Experience | Upgrade online platforms, enhance mobile apps |

| Customer Personalization | Utilize advanced analytics, deploy targeted marketing |

| Innovation Culture | Host hackathons, establish innovation labs |

| Fintech Partnerships | Collaborate on new technologies, integrate solutions |

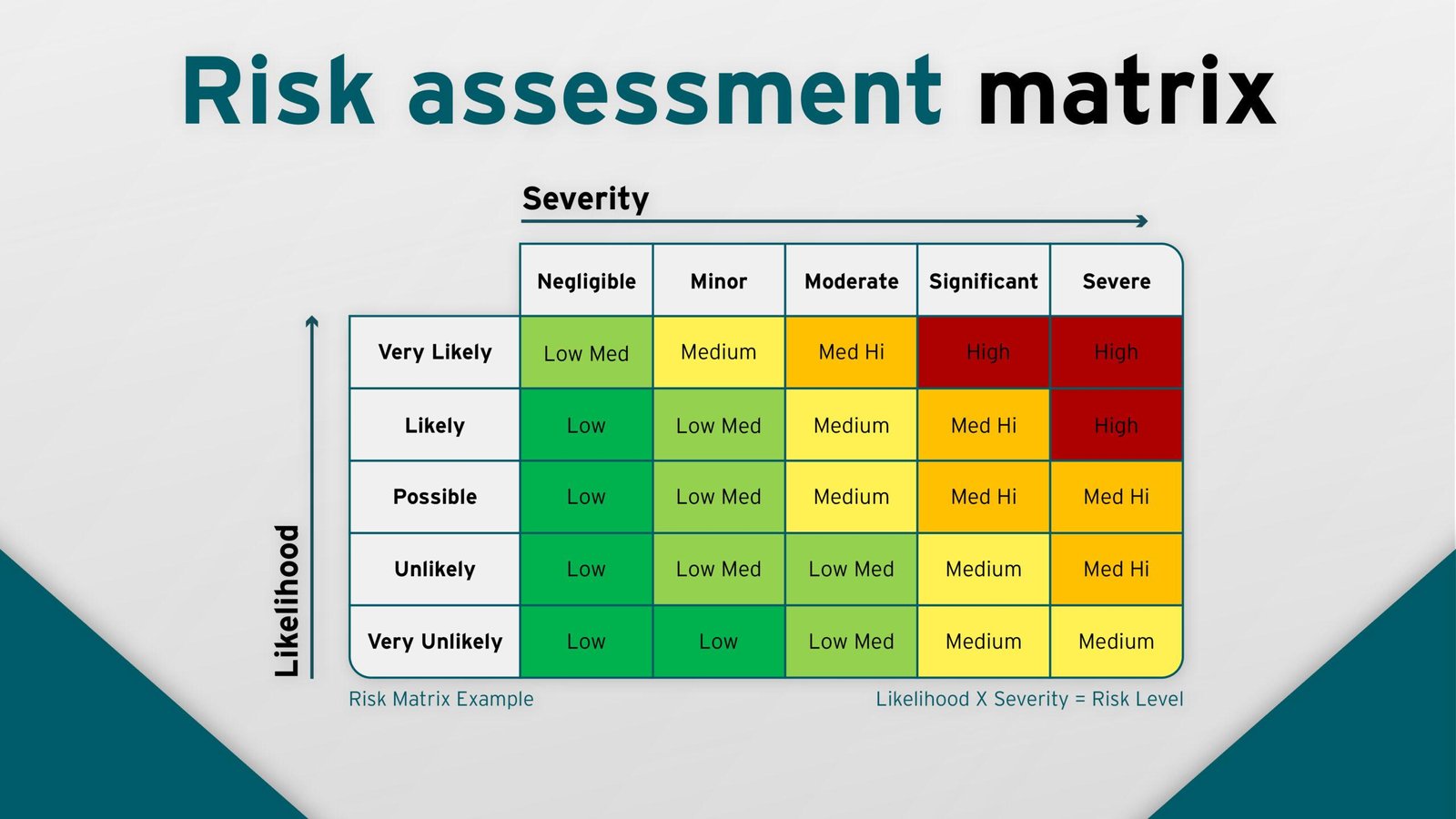

Risk Assessment and Mitigation Strategies

Effective risk evaluation is crucial in ensuring that HDFC Bank navigates its operational landscape successfully. This involves a meticulous process of identifying potential hazards, assessing their probability, and analyzing their impact. Key areas to focus on include financial risks, regulatory compliance, cybersecurity challenges, and natural disasters. To systematically approach this evaluation, teams can utilize various tools such as SWOT analysis, scenario planning, and statistical methods to bolster decision-making. This tailored approach enables HDFC Bank to pinpoint vulnerabilities and allocate resources efficiently. Critical steps include:

- Hazard Identification: Recognizing distinctive threats within the financial and operational frameworks.

- Risk Analysis: Estimating the likelihood and potential impact of these threats.

- Risk Evaluation: Prioritizing risks based on their severity and the organization’s risk appetite.

Once risks are identified and analyzed, HDFC Bank can implement effective mitigation strategies tailored to its unique circumstances. These strategies may encompass strengthening internal controls, enhancing employee training, and investing in technology to provide real-time monitoring and alerts. Moreover, establishing a robust compliance framework will ensure adherence to national and international regulations. A collaborative culture is vital, wherein all levels of staff engage in risk management discussions. The following table summarizes potential mitigation tactics and their objectives:

| Mitigation Strategy | Objective |

|---|---|

| Risk Training Programs | Enhance staff awareness and preparedness for potential risks. |

| Advanced Cybersecurity Measures | Protect sensitive data and reduce the likelihood of breaches. |

| Regular Compliance Audits | Ensure adherence to laws and regulations while mitigating fines. |

To Wrap It Up

the HDFC Bank Research Report serves as a compelling lens through which we can understand the nuances of the Indian banking landscape. By meticulously analyzing financial performance, market trends, and strategic initiatives, it not only sheds light on HDFC Bank’s current standing but also illuminates the pathways that may define its future. As investors and stakeholders navigate this ever-evolving environment, the insights gleaned from such reports become invaluable touchstones for informed decision-making.

Whether you’re a seasoned investor or a casual observer, the depth and rigor of the analysis provided in the report underscore the bank’s commitment to transparency and growth. As we look ahead, staying attuned to these insights can empower us to better understand the financial dynamics at play in one of India’s foremost banking institutions. In a world where knowledge is power, the HDFC Bank Research Report stands out as a key resource for those seeking clarity amidst complexity.