gold research report

Introduction: The Allure of Gold – A Deep Dive into Current Research

Gold, often regarded as a timeless symbol of wealth and stability, continues to captivate investors and researchers alike in a rapidly evolving economic landscape. The year 2024 has seen gold shine brightly, appreciating by 12% year-to-date and consistently outperforming many major asset classes. This impressive performance has been fueled by several factors, including persistent central bank acquisitions, robust Asian investment interest, and an unrelenting wave of geopolitical uncertainties driving consumer demand for this precious metal[1].

As we explore the current trends and analyses in gold market dynamics, this research report will delve into the myriad influences shaping its trajectory. From the implications of central bank policies to shifts in global consumption patterns, understanding the multifaceted role of gold in contemporary finance is crucial. Moreover, recent bullish indicators suggest that the potential for further gains remains promising, underscoring the importance of continuous research in this area[2]. Join us on this insightful journey as we uncover the latest findings, trends, and forecasts related to gold, a cornerstone of investment strategy and economic resilience.

Understanding the Current Gold Market Trends and Their Implications

Recent trends in the gold market indicate a significant shift driven by various macroeconomic factors. Gold prices have surged in 2024, influenced by escalating geopolitical risks, fluctuating interest rates, and persistent inflation concerns. Central banks are also increasingly turning to gold as a safe haven asset, further propelling demand. Market participants should note the importance of understanding these dynamics, as they not only affect spot prices but also contribute to long-term investment strategies. Key considerations include:

- Geopolitical Instability: Heightened tensions globally.

- Interest Rates: Impact of central bank policies.

- Inflation Rates: Gold as a hedge against rising prices.

- Market Sentiment: Investor perceptions and their influence on pricing.

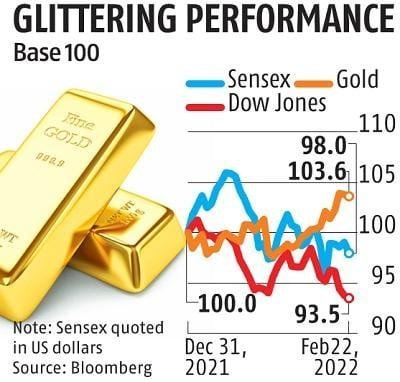

The fluctuations observed in gold prices can be attributed to a complex interplay of supply and demand forces. Notably, the correlation between gold prices and inflation is becoming more pronounced, which serves as an essential alert for investors. A detailed analysis of recent price movements reveals that gold has outperformed other asset classes, with growing confidence among investors regarding its potential to retain value amidst economic uncertainty. Below is a brief overview of recent gold price performance:

| Period | Price per Ounce (USD) | Change (%) |

|---|---|---|

| January 2024 | $1,900 | +5% |

| April 2024 | $2,050 | +8% |

| Current (September 2024) | $2,200 | +7% |

Analyzing Historical Performance to Forecast Future Gold Prices

In the intricate dance of market dynamics, understanding historical performance serves as a critical compass for forecasting future trends in gold prices. Analyzing periods of economic upheaval, geopolitical tensions, and fluctuating currency values can unveil patterns that often replay themselves over time. For instance, the financial crisis of 2008 propelled gold to unprecedented heights, demonstrating its allure as a safe-haven asset amid uncertainty. By scrutinizing these past cycles, we can identify indicators that signal potential shifts, such as rising inflation rates or declining stock market confidence, which historically lead to increased demand for gold.

To facilitate a deeper understanding, we can break down the historical price movements associated with key global events. This involves examining various factors that have influenced gold prices, including interest rates, currency fluctuations, and market sentiment. The following table summarizes these critical influences alongside corresponding gold price responses:

| Event | Influence | Gold Price Movement |

|---|---|---|

| 2008 Financial Crisis | High Uncertainty | ↑ 25% |

| COVID-19 Pandemic | Global Economic Slowdown | ↑ 30% |

| US-China Trade War | Market Volatility | ↑ 20% |

Such analyses not only reveal the relationship between gold and macroeconomic events but also empower investors to make informed decisions based on historical patterns. By recognizing these elements, traders and analysts can better position themselves, harnessing the predictive power of past performance to anticipate gold market movements with greater accuracy.

Evaluating the Impact of Global Events on Gold Investment Strategies

Global events significantly shape and influence gold investment strategies, often acting as both catalysts and deterrents for investors. For instance, during periods of economic uncertainty—driven by geopolitical tensions, natural disasters, or pandemics—gold is frequently considered a “safe haven” asset. Investors typically flock to gold, anticipating its stability compared to more volatile assets like stocks. The following factors often compel investors to reassess their strategies:

- Inflation Rates: High inflation tends to diminish the purchasing power of currency, making gold a preferred store of value.

- Interest Rates: Lower interest rates can decrease the opportunity cost of holding gold, prompting increased investment.

- Political Instability: Unrest and uncertainty encourage investors to seek safe investments, leading to spikes in gold demand.

The impact of these events can be quantified through an analysis of gold price movements during key occurrences in global markets. For a clearer understanding, the table below illustrates historical gold price fluctuations relative to notable global events:

| Event | Date | Gold Price Movement |

|---|---|---|

| Financial Crisis | 2008 | +25% |

| COVID-19 Pandemic | 2020 | +30% |

| Ukraine Conflict | 2022 | +15% |

In evaluating these trends, it becomes apparent that investors must stay vigilant, adjusting their gold acquisition and sale strategies based on ongoing global developments. The interplay between these events and market responses to gold is critical in determining optimal investment timing.

Strategic Recommendations for Diversifying Gold Assets in Your Portfolio

To effectively diversify your gold assets, consider incorporating a variety of gold investment vehicles that align with your financial goals and risk tolerance. Some options include:

- Physical Gold – Investing in bullion coins or bars, which can provide tangible value and act as a hedge against inflation.

- Gold ETFs – Exchange-traded funds that offer exposure to gold prices without the need for physical storage, providing liquidity and ease of trading.

- Gold Mining Stocks – Investing in shares of companies that mine gold can yield high returns, though they come with additional market risk.

- Gold Mutual Funds – These funds pool money from multiple investors to buy a diversified portfolio of gold-related stocks, giving you broader market exposure.

Additionally, it’s essential to regularly assess the performance of your gold investments in conjunction with other assets in your portfolio. A strategic allocation might resemble the following:

| Asset Class | Percentage Allocation (%) |

|---|---|

| Physical Gold | 20 |

| Gold ETFs | 30 |

| Gold Mining Stocks | 25 |

| Gold Mutual Funds | 25 |

By diversifying across these different categories, you can mitigate risks associated with market volatility while also enhancing the potential for stable, long-term growth in your gold assets.

Concluding Remarks

In closing, our exploration of gold research highlights the precious metal’s pivotal role in the global economic landscape. From the promising projections by J.P. Morgan, which anticipate gold prices reaching $2,500 per ounce by the end of 2024, to the insights shared by the World Gold Council on gold’s impressive performance amidst ongoing geopolitical uncertainties, it is evident that gold continues to attract interest as a safe haven and a strategic investment choice. As we navigate the evolving market dynamics and consumer behaviors, the multifaceted nature of gold—encompassing both its historical significance and modern-day applications—remains a topic worthy of ongoing exploration and analysis. Whether through the lens of economic forecasts or advancements in gold technology as noted in the Gold Bulletin, the dialogue surrounding gold is rich and ever-evolving, inviting us all to stay engaged and informed.

As we move forward, let us keep a close eye on the trends and insights that will shape the future of gold investment, ensuring that we remain equipped with the knowledge necessary to make informed decisions in this dynamic arena.