equity research reports

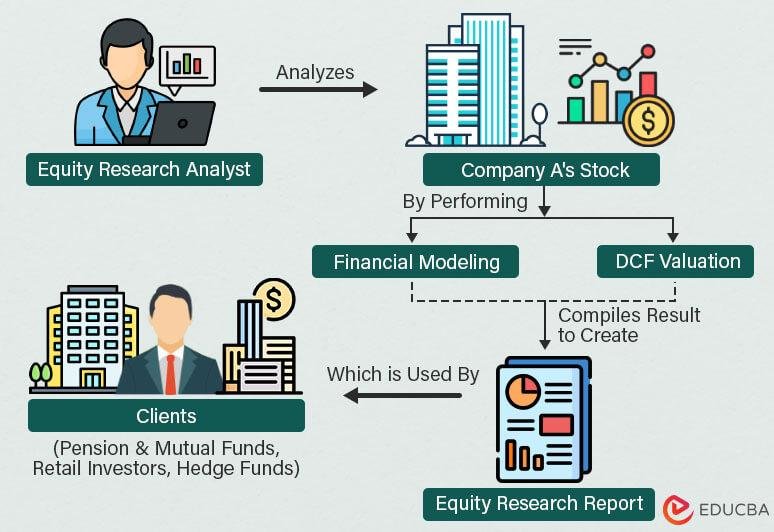

In the intricate tapestry of financial markets, where numbers dance and trends weave stories, equity research reports emerge as essential narrative threads. These comprehensive documents serve as both compass and guide, illuminating the often-overwhelming landscape of publicly traded companies. Whether you’re a seasoned investor, a curious newcomer, or a financial analyst navigating the currents of stock valuation, equity research reports offer insights that can shape decisions and strategies. Delving into performance analysis, competitive positioning, and market forecasts, these reports distill vast amounts of data into digestible narratives, empowering stakeholders with the information they need to make informed choices. In this article, we will explore the key components, methodologies, and significance of equity research reports, and uncover how they play a pivotal role in the interplay between information and investment in today’s dynamic economic environment.

Understanding the Foundations of Equity Research Reports

At the core of equity research reports lies a structured analysis of stocks, aimed at providing investors with a comprehensive understanding of a company’s financial health and market position. These reports encompass several critical components, such as financial statements, market trends, and economic indicators. Each section plays a pivotal role in determining whether a stock is a sound investment. Typically, a thorough report will cover:

- Company Overview: A brief description of the business, its core operations, and competitive landscape.

- Financial Analysis: An in-depth assessment of revenue, profits, cash flow, and debt levels.

- Market Analysis: Evaluation of current market conditions and forecasted trends.

- Investment Thesis: The analyst’s perspective on why the stock is undervalued or overvalued.

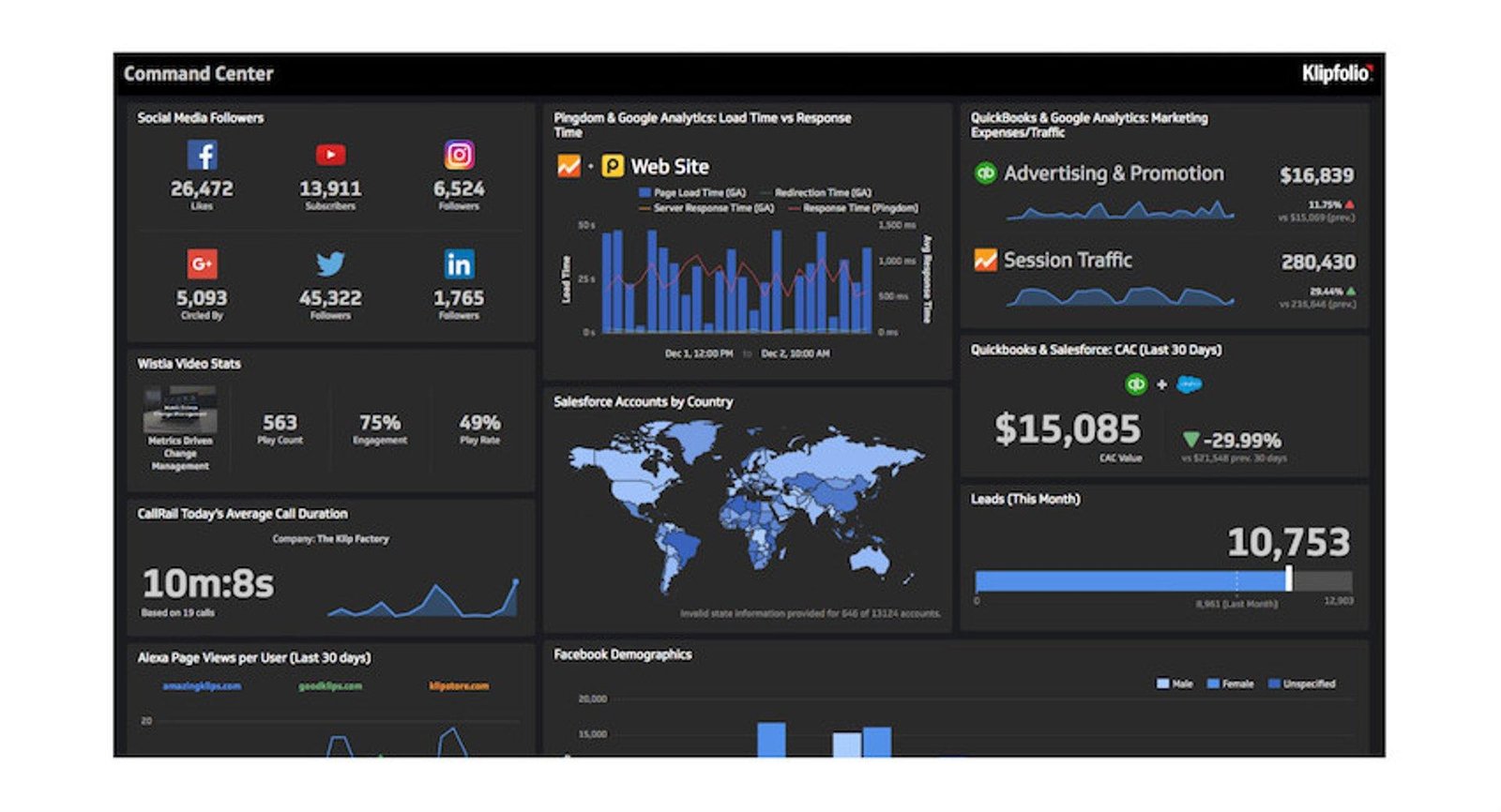

Furthermore, effective equity research reports utilize visual aids, such as charts and tables, to succinctly present information. A well-organized table might summarize key financial metrics over several fiscal years, making it easier for investors to grasp performance trends at a glance. Here’s an example of how such a table could be structured:

| Year | Revenue ($M) | Net Income ($M) | Earnings Per Share ($) |

|---|---|---|---|

| 2021 | 500 | 50 | 2.50 |

| 2022 | 550 | 65 | 3.25 |

| 2023 | 600 | 80 | 4.00 |

These elements collectively form the foundation of equity research reports, empowering investors with the necessary insights to make informed decisions in the stock market.

Analyzing Market Trends and Their Impact on Valuation

Understanding the dynamics of various market trends is essential for accurate valuation in equity research. Factors such as economic indicators, consumer behavior, and industry developments all intertwine to influence stock prices. Analysts must consider a range of aspects when evaluating these trends, including:

- Market Sentiment: The collective mood of investors can greatly affect stock valuation.

- Regulatory Changes: New laws and regulations can disrupt or enhance market landscapes.

- Technological Advancements: Innovations can lead to competitive advantages or losses, influencing overall market dynamics.

Furthermore, it is crucial for researchers to examine historical data alongside current trends to create a more comprehensive valuation model. The use of timely market reports and statistical analysis can aid in forecasting future performance, especially when identifying growth sectors or potential downturns. A well-structured approach to data analysis can be illustrated in the following table:

| Market Trend | Impact on Valuation |

|---|---|

| Growth in E-commerce | Increased valuation for retail tech companies. |

| Rising Interest Rates | Potential decline in high-growth tech valuations. |

| Sustainability Focus | Higher valuation for green energy firms. |

Key Metrics and Ratios in Effective Investment Analysis

Investment analysis relies heavily on key metrics and ratios to provide a clearer picture of a company’s financial health and performance potential. Investors should focus on a variety of indicators that help assess both current value and future growth. Some of the most important metrics include:

- Price-to-Earnings (P/E) Ratio: This ratio indicates the market’s valuation of a company’s earnings.

- Debt-to-Equity (D/E) Ratio: This measures the company’s financial leverage by comparing its total liabilities to shareholders’ equity.

- Return on Equity (ROE): A high ROE signifies effective management and strong profit generation.

In addition to these ratios, cash flow metrics are crucial for understanding a company’s liquidity and operational efficiency. The Free Cash Flow (FCF) can be particularly insightful, as it shows the cash available after capital expenditures for expansion, dividends, and debt repayments. Other essential metrics to consider include:

- Current Ratio: A liquidity measure expressing a company’s ability to pay short-term obligations.

- Operating Margin: This indicates the percentage of revenue that remains after covering operating expenses, providing a glimpse into profitability.

- Earnings Before Interest and Taxes (EBIT): A measure used to analyze a company’s profitability without considering its capital structure.

| Metric | Importance |

|---|---|

| P/E Ratio | Valuation of earnings |

| D/E Ratio | Financial leverage insight |

| ROE | Management effectiveness |

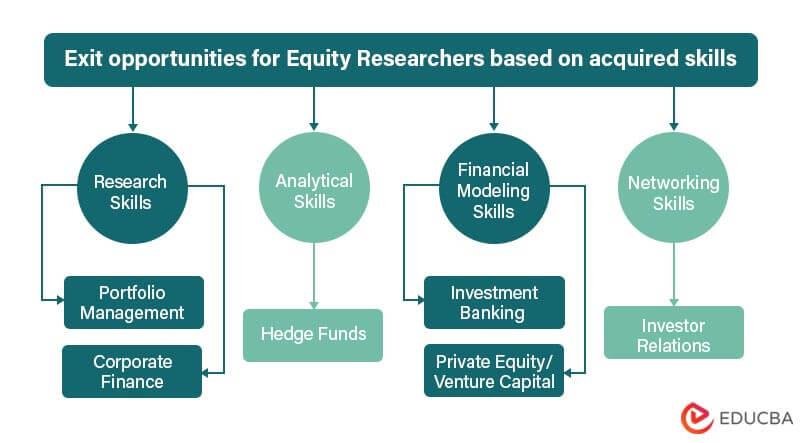

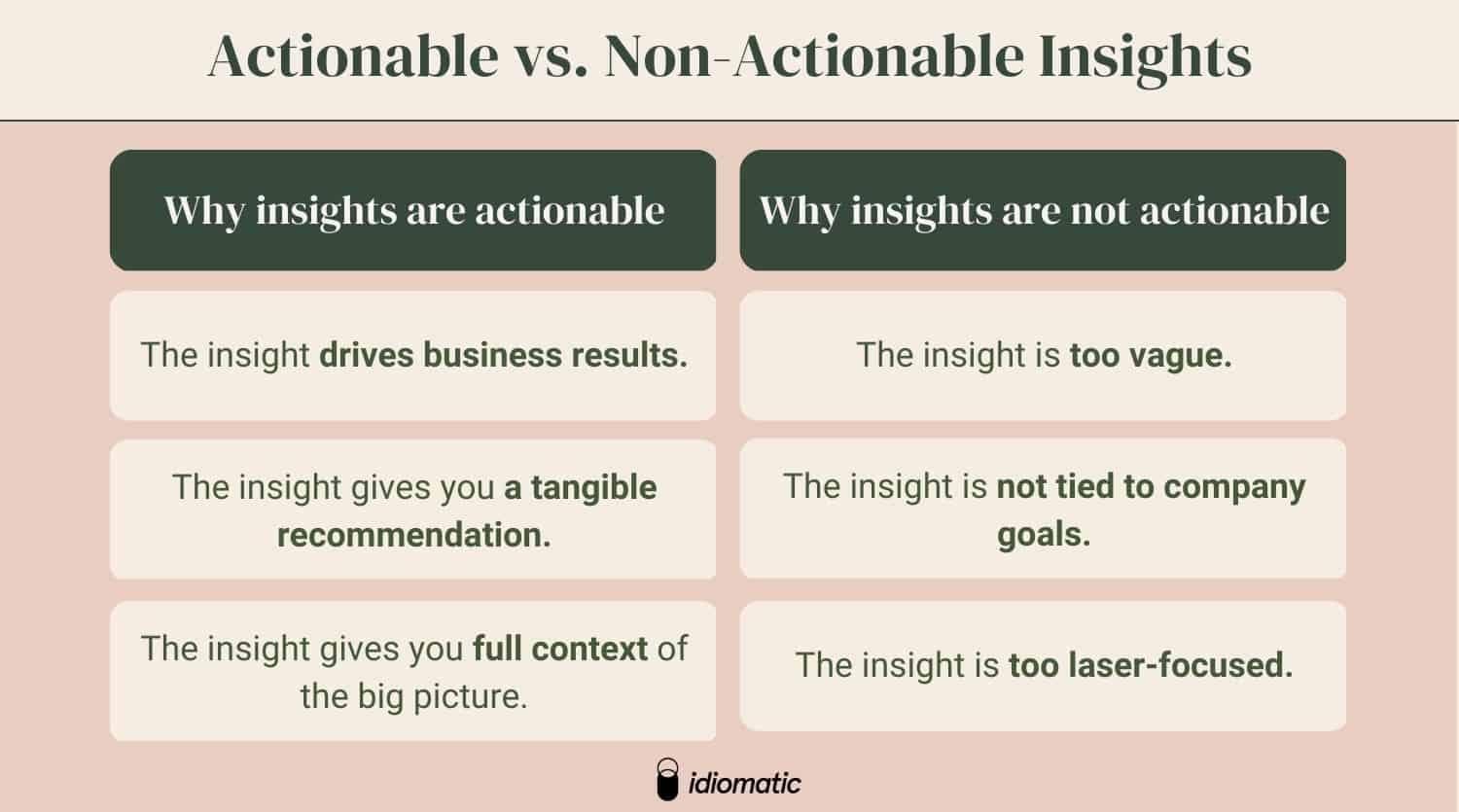

Actionable Insights: Translating Research into Investment Strategy

Investors can leverage *equity research reports* to develop informed strategies by focusing on key metrics and insights provided by analysts. These reports often distill complex data into actionable recommendations, indicating whether investors should buy, hold, or sell a particular stock. By synthesizing market trends, financial health indicators, and macroeconomic factors, equity research serves as a compass for investors navigating the stock market. Important elements to monitor include:

- Earnings reports: Analyzing past performance for predicting future growth.

- Valuation multiples: Comparing companies within the same sector.

- Market sentiment: Understanding investor mood and potential impacts on stock prices.

To effectively utilize these insights, investors should consider creating a strategic framework that incorporates findings from equity research. A clear approach might include assessing which sectors to target based on economic forecasts and identifying companies showing consistent performance against their peers. Additionally, a comparison table can clarify the advantages and risks associated with various investment options:

| Investment Option | Risk Level | Potential Return |

|---|---|---|

| Tech Stocks | Medium | High |

| Bonds | Low | Moderate |

| Consumer Goods | Low to Medium | Moderate |

Future Outlook

In the intricate tapestry of financial markets, equity research reports serve as essential threads, weaving together data, analysis, and insight. As we’ve explored, these documents not only illuminate the performance and potential of companies but also guide investors in navigating the often tumultuous waters of investment decisions. With their capacity to distill complex information into comprehensible narratives, equity research reports empower both seasoned investors and newcomers alike.

As you embark on your own investment journey, consider these reports not just as tools but as companions—offering clarity amid uncertainty, and helping to sharpen your strategic edge. The world of equity is ever-evolving, rich with opportunities and challenges alike. Continuing to engage with these reports will not only enhance your financial literacy but also deepen your understanding of the market dynamics at play. In a realm defined by volatility and change, knowledge is indeed your most valuable asset. Thank you for joining us on this exploration, and may your future investments be informed and fruitful.