equity research report download

In the ever-evolving landscape of financial markets, the quest for insightful data and comprehensive analysis has led investors to seek out equity research reports as indispensable tools for decision-making. These reports encapsulate a wealth of information, providing detailed assessments of publicly traded companies, sector performance, and potential investment opportunities. As investors navigate the complexities of stock valuation and market trends, the importance of these research documents cannot be overstated. In this article, we will explore the significance of downloading equity research reports, what to look for in them, and how they can empower you to make informed investment choices in today’s dynamic financial environment. Whether you are a seasoned investor or just starting your journey in the stock market, understanding the nuances of equity research is crucial to making well-informed decisions that align with your financial goals.

Understanding the Essentials of Equity Research Reports

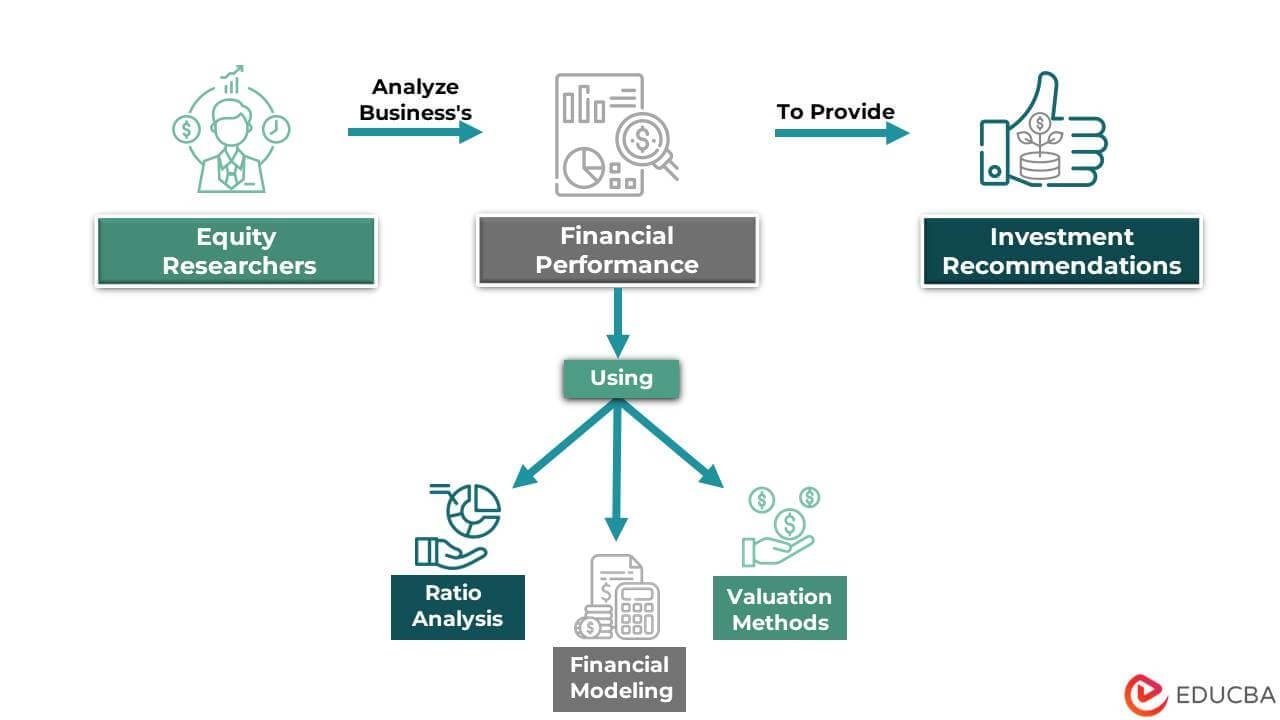

Equity research reports serve as crucial tools for investors, providing detailed insights into publicly traded companies and the overall market. These reports typically include financial analysis, valuation models, and investment recommendations, which help stakeholders make informed decisions. Key components of these documents may include:

- Company Overview: A snapshot of the company’s operations, market position, and strategic goals.

- Financial Performance: Analysis of key financial metrics such as earnings, revenue, and profit margins.

- Market Trends: Insights into sector trends and macroeconomic factors influencing the company.

- Risk Assessment: Identification of potential risks that could impact future performance.

- Valuation: Evaluation methods like DCF (Discounted Cash Flow) analysis to determine the fair value of the company.

When drafting or reviewing equity research reports, it’s essential to adhere to best practices to enhance clarity and usability. Reports should be structured logically, ensuring that each section flows coherently into the next. Visual aids like charts and tables can significantly enhance comprehension, presenting complex data in an accessible format. For instance, a simple valuation comparison table can succinctly showcase performance against peers:

| Company | Current Price | P/E Ratio | Target Price |

|---|---|---|---|

| Company A | $150 | 25 | $180 |

| Company B | $80 | 20 | $95 |

| Company C | $200 | 30 | $220 |

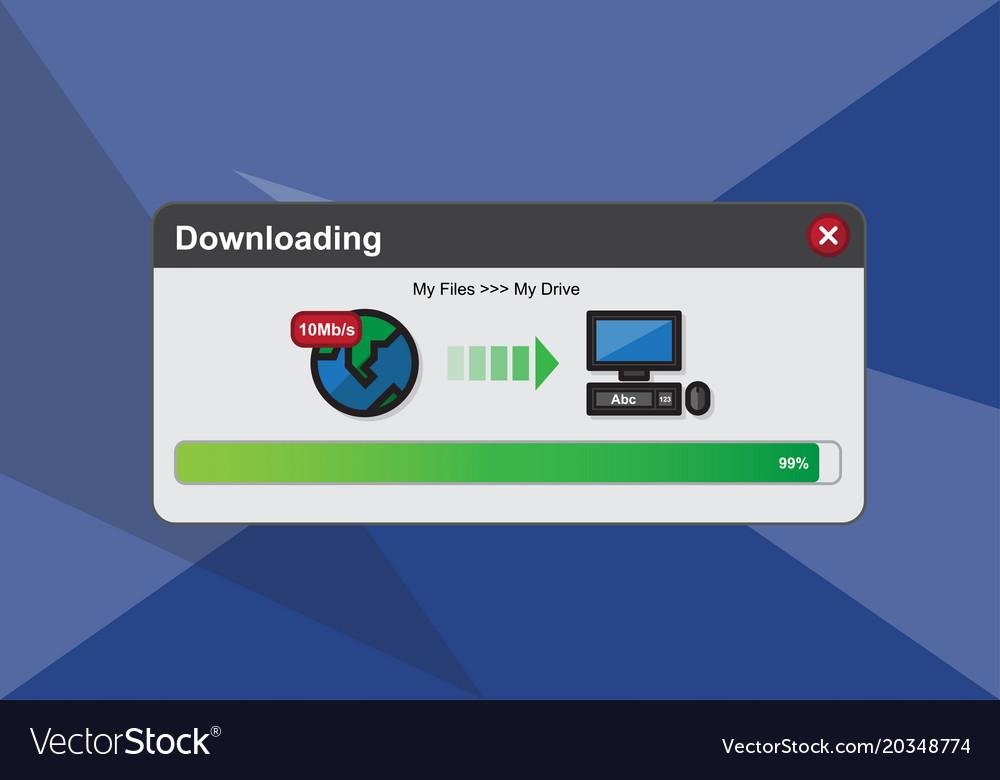

Navigating the Download Process for Efficient Access

To ensure a seamless experience when accessing equity research reports, it’s crucial to be familiar with the various steps involved in the download process. Start by locating the desired report on the website. Utilize the search functionality or browse through categories such as Industry Reports, Company Analysis, or Market Trends. Once you have identified the report, click on the corresponding link to view a summary. Pay attention to any access restrictions or subscription requirements mentioned, as these may impact your ability to download.

After confirming that you have the necessary permissions, proceed to the download button. Depending on the platform, you may be presented with different file formats such as PDF or Excel. Before clicking the download link, check for any additional fields or options that might be required, such as entering your email or inputting a password. To aid in your navigation, here’s a quick overview of the common download procedures:

- Locate the report in the designated section.

- Verify any access requirements or disclaimers.

- Choose your preferred file format.

- Complete any necessary authentication.

- Click ‘Download’ and save the file to your device.

Maximizing Insights Through Detailed Analysis Techniques

“`html

To obtain valuable insights in equity research, it’s essential to employ a range of analytical techniques that allow for comprehensive evaluations of companies. These techniques include:

- Financial Modeling: Creating detailed models to forecast a company’s financial performance using key metrics such as earnings, revenues, and cash flows.

- Ratio Analysis: Utilizing liquidity, profitability, and leverage ratios to assess a firm’s financial health compared to its peers.

- Valuation Methods: Applying techniques like Discounted Cash Flow (DCF) and Comparable Company Analysis (CCA) to determine a company’s intrinsic value.

- SWOT Analysis: Analyzing the strengths, weaknesses, opportunities, and threats faced by a company to understand its competitive position.

Furthermore, leveraging technology can streamline the data analysis process, enhancing the quality of insights derived. Key tools in this enhancement include:

- Data Visualization Software: Tools like Tableau and Power BI help in presenting data intuitively, making complex information more accessible.

- Statistical Software: Programs such as R and Python facilitate advanced analytics and simulations.

- Automated Reporting Tools: These can generate real-time updates and periodic reports, ensuring analysts have the latest data at their fingertips.

“`

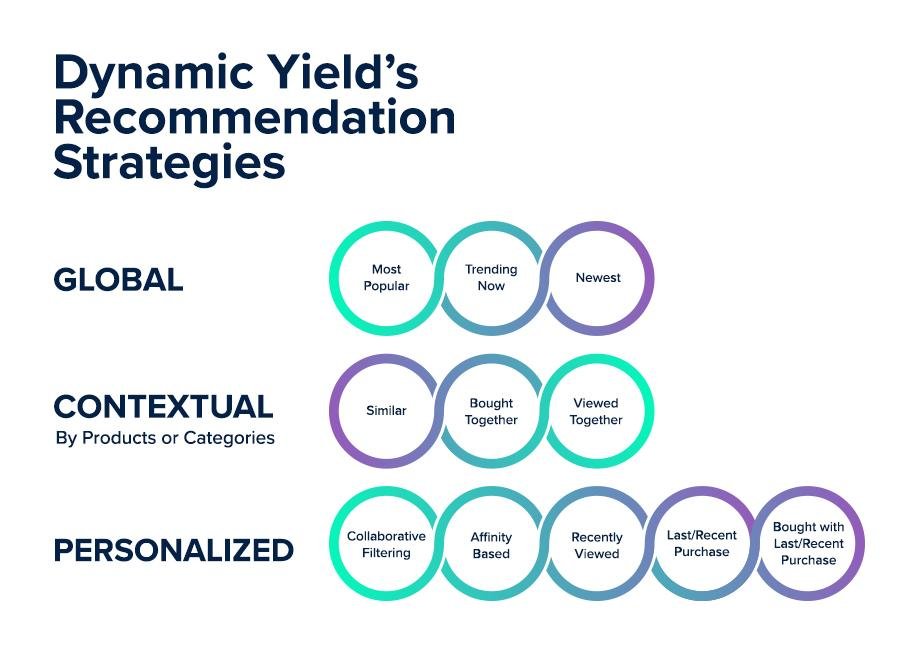

Strategic Recommendations for Utilizing Research Effectively

To harness the full potential of equity research, it is crucial to develop a well-structured approach to analyzing reports. Start by focusing on key metrics such as earnings per share (EPS), price-to-earnings (P/E) ratios, and return on equity (ROE). Understanding these indicators allows investors to evaluate a company’s financial health quickly. Additionally, leverage qualitative insights from research reports, which often highlight management effectiveness, market positioning, and competitive advantages. These aspects can offer valuable context that complements quantitative data.

Furthermore, employing a systematic decision-making framework can enhance the effectiveness of research utilization. Consider categorizing findings into actionable items, such as buy, hold, or sell recommendations, based on thorough analysis. This can be visually represented in a simple HTML table for clarity:

| Recommendation | Action | Rationale |

|---|---|---|

| Buy | Invest immediately | Strong fundamentals and growth potential |

| Hold | Monitor closely | Stable company performance |

| Sell | Divest shares | Weak financial indicators |

By implementing these strategies, investors can ensure that they are deriving maximum value from equity research reports, leading to informed and strategic investment decisions.

Final Thoughts

As we conclude our exploration of equity research reports, we hope this resource has illuminated the critical role these documents play in guiding investment decisions and understanding market dynamics. With a wealth of information at your fingertips, downloading an equity research report can empower you to make informed choices, whether you’re an investor seeking to enhance your portfolio or a student aiming to grasp the intricacies of financial analysis.

Remember, equity research isn’t just about numbers; it’s about storytelling—the narrative behind the data that helps you envision the future of companies and industries. By accessing these reports, you gain insights crafted by professionals who sift through the complexities of finance to present a clearer picture of value and opportunity.

So, whether you’re ready to dive into your next download or merely considering the possibilities, know that each report is a step closer to mastering the market. Unlock the potential of equity research today and steer your financial journey with knowledge and confidence.