Customize Profit And Loss In Quickbooks Online

Navigating Profit and Loss Customization in QuickBooks Online: A Comprehensive Guide

In the fast-paced world of finance, businesses rely on accurate and detailed financial reporting to inform strategic decisions and drive growth. Among the essential tools in a company’s accounting arsenal, QuickBooks Online stands out, offering users the flexibility to tailor their Profit and Loss statements to suit specific needs. Customizing these reports not only enhances clarity but also empowers business owners to gain deeper insights into their financial health. This article delves into the intricacies of customizing Profit and Loss reports in QuickBooks Online, exploring the features and functionalities that allow users to shape their financial narratives. With a focus on practical tips and best practices, we aim to equip entrepreneurs and financial professionals with the knowledge to maximize their reporting capabilities and foster informed decision-making. Whether you are a seasoned QuickBooks user or a newcomer navigating the platform, understanding how to effectively customize your Profit and Loss statements is a crucial step in elevating your financial management strategy.

Table of Contents

- Understanding the Profit and Loss Statement in QuickBooks Online

- Key Customization Features for Tailoring Your Financial Reports

- Best Practices for Analyzing Customized Profit and Loss Statements

- How to Generate Actionable Insights from Your Customized Reports

- Q&A

- Future Outlook

Understanding the Profit and Loss Statement in QuickBooks Online

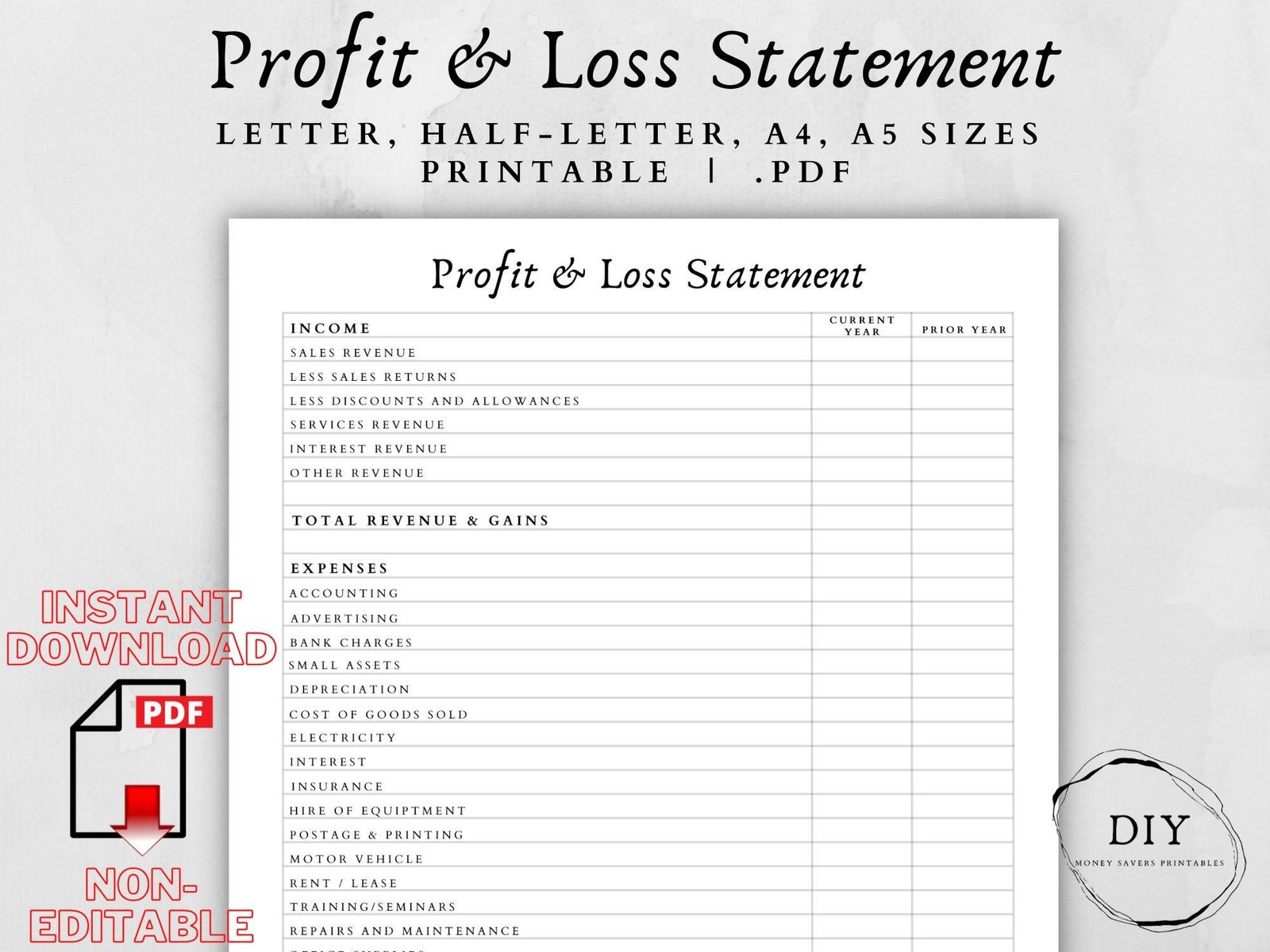

To effectively navigate the Profit and Loss statement in QuickBooks Online, it’s essential to grasp its key components. This financial tool provides a comprehensive view of your business’s income and expenses over a specified period. By analyzing this statement, you can determine your operational effectiveness and make informed decisions for future strategies. Some of the critical elements include:

- Revenue: Total money generated from sales and services.

- Cost of Goods Sold (COGS): Direct costs tied to the production of goods sold.

- Gross Profit: Revenue minus COGS, indicating overall profitability before deducting operating expenses.

- Operating Expenses: Costs incurred from normal business operations excluding COGS.

- Net Income: The final profit or loss after all expenses are subtracted from total revenue.

Customizing your Profit and Loss statement in QuickBooks Online allows you to tailor the insights to your specific business needs. You can adjust the reporting period, add filters based on different categories, and even choose how to present the data. For example, incorporating a comparison to previous periods can provide a clearer picture of financial trends. Utilizing the available customization options, you can create a more meaningful analysis by focusing on:

| Customization Option | Benefit |

|---|---|

| Adjust Reporting Period | Identifies trends over specific timeframes. |

| Filters by Categories | Analyzes performance by product or service type. |

| Comparison to Previous Periods | Measures growth and performance improvements. |

Key Customization Features for Tailoring Your Financial Reports

QuickBooks Online offers a multitude of customization options to enhance the way you generate and analyze your financial reports. By tailoring the Profit and Loss statement to your specific needs, you can better understand your business performance. Key features include:

- Custom Date Ranges: Select specific time frames to compare performance over weeks, months, or years.

- Class and Location Tracking: Analyze income and expenses by department, project, or geographical location.

- Grouping Options: Organize income and expenses into distinct categories for easier insights.

Moreover, QuickBooks allows users to refine reports by adjusting the output format, ensuring clarity and accessibility. You can utilize filters to focus on certain elements such as:

- Income Types: Differentiate between various sources of income to get a detailed understanding of revenue streams.

- Expense Types: Dive deep into operational costs by examining expense breakdowns.

- Comparative Reports: Compare performance metrics against previous periods to identify trends and patterns.

| Customization Feature | Benefit |

|---|---|

| Custom Date Ranges | Monitor specific periods for targeted insights. |

| Class and Location Tracking | Get granular views of financial performance. |

| Expense Categorization | Pinpoint areas for cost-saving measures. |

Best Practices for Analyzing Customized Profit and Loss Statements

html

When analyzing customized profit and loss statements, it's crucial to adhere to systematic methodologies to extract valuable insights. Start by setting clear objectives for your analysis: what financial metrics matter most for your business goals? Identify key areas such as gross margin, operating expenses, and net profit to help focus your review. Ensure that your data is clean and accurately reflects your transactions in QuickBooks Online. Utilizing features like filters and segmentations can enhance your analysis by allowing you to view specific categories or timeframes, leading to more informed decision-making.

Incorporating visually engaging elements can also bolster your understanding of the data. Use charts and graphs to represent trends over time, making complex financial information more digestible. Additionally, implementing budget comparisons within your customized profit and loss statement can highlight variances and help in understanding the reasons behind unexpected results. Consider summarizing key takeaways in a table format for quick reference, focusing on your most critical financial indicators. For instance:

Metric

This Period

Last Period

Variance

Gross Margin

$15,000

$12,500

+$2,500

Operating Expenses

$5,000

$4,800

+$200

Net Profit

$10,000

$7,700

+$2,300

How to Generate Actionable Insights from Your Customized Reports

In the fast-paced world of finance, leveraging your customized reports to derive actionable insights is crucial for staying ahead. Start by examining key performance indicators (KPIs) that directly reflect the financial health of your business. This could involve analyzing metrics such as net profit margin, operating expenses, and revenue growth. By establishing a set of benchmarks, you can pinpoint areas needing improvement or investment. For instance, if your operating expenses are climbing while revenue remains stable, this signals a need to audit your cost structure or identify efficiency gains.

Once you’ve identified critical trends, it’s time to diversify your analysis methods. Consider breaking down your profit and loss statements into product lines or service categories for a granular view of performance. This allows you to emphasize resources on the most profitable segments and strategically plan for the underperforming ones. Utilizing visual aids, such as graphs and tables, can make the data more digestible. For example, a simple comparative table can illustrate Monthly Revenue versus Expenses across different departments:

| Department | Monthly Revenue | Monthly Expenses |

|---|---|---|

| Sales | $20,000 | $10,000 |

| Marketing | $15,000 | $12,000 |

| Operations | $25,000 | $14,000 |

Q&A

Q&A: Customizing Profit and Loss in QuickBooks Online

Q: What is the Profit and Loss report in QuickBooks Online, and why is it important for businesses?

A: The Profit and Loss report, often referred to as the income statement, is a financial document that summarizes a company’s revenues and expenses over a specified period. This report is vital for businesses as it provides insights into operational efficiency, profitability, and financial health. By analyzing this report, business owners can make informed decisions about growth strategies, cost management, and resource allocation.

Q: Can users easily customize their Profit and Loss reports in QuickBooks Online?

A: Yes, QuickBooks Online offers a user-friendly interface that allows businesses to tailor their Profit and Loss reports to meet specific needs. Users can adjust various parameters, such as date ranges, account types, and comparison periods, which allows for a better representation of financial performance that suits their reporting requirements.

Q: What are some common ways users can customize their Profit and Loss reports?

A: Users can customize their reports in several ways, including:

- Date Range: Adjusting the report to reflect daily, monthly, quarterly, or annual performance.

- Columns: Choosing to compare current figures with previous periods or budgets.

- Filters: Selecting specific accounts or categories to focus on particular aspects of business performance.

- Formatting Options: Modifying fonts, colors, and layouts for easier readability and presentation purposes.

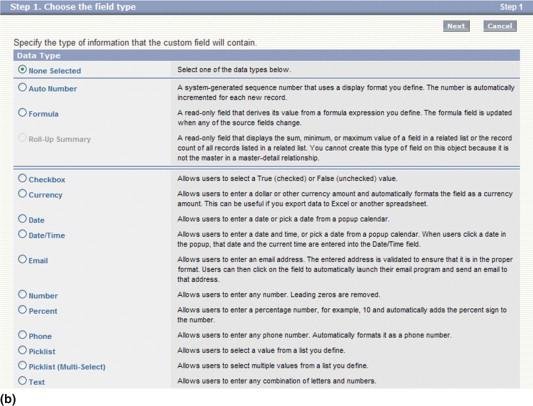

Q: Are there any advanced customization options available in QuickBooks Online?

A: Yes, QuickBooks Online provides advanced customization features for users seeking more detailed reporting. Users can create custom reports using the “Custom Reports” feature, which enables them to include specific metrics, group transactions, and use calculated fields. This is particularly useful for businesses that need to drill down into specific areas of their operations or sector-specific financial requirements.

Q: Can users export their customized Profit and Loss reports to other formats?

A: Absolutely. QuickBooks Online allows users to export their customized Profit and Loss reports in several formats, including PDF and Excel. This versatility supports sharing with stakeholders, presenting at meetings, or facilitating further analysis outside the QuickBooks environment.

Q: What are the key benefits of customizing Profit and Loss reports in QuickBooks Online?

A: Customizing Profit and Loss reports provides numerous benefits, such as:

- Enhanced Decision-Making: Tailoring reports to focus on critical data helps business owners make timely and informed decisions.

- Improved Visibility: Customized reports help identify trends, opportunities, and areas needing attention more easily.

- Increased Accountability: Detailed insights into expenses and revenues allow for better tracking of financial performance against budgets and forecasts.

- Professional Presentation: Well-formatted reports can impress stakeholders and serve as effective communication tools.

Q: Is there a learning curve for new users trying to customize their Profit and Loss reports in QuickBooks Online?

A: While there may be an initial learning curve for new users, QuickBooks Online provides various resources, including help articles, video tutorials, and customer support. Most users find that once they familiarize themselves with the platform, customizing reports becomes a straightforward process. The intuitive nature of the software is designed to make financial management accessible to users, regardless of their prior accounting experience.

Q: Where can users find more information on customizing Profit and Loss reports in QuickBooks Online?

A: Users can access a wealth of information through QuickBooks Online’s Help Center, which offers step-by-step articles and guides on report customization. Additionally, community forums, webinars, and bookkeeping courses are available for those seeking deeper insights or advanced techniques. For personalized assistance, reaching out to a QuickBooks certified professional can also provide tailored advice and training.

Future Outlook

customizing Profit and Loss statements in QuickBooks Online is not just a feature; it’s a strategic tool that empowers businesses to gain deeper insights into their financial health. By tailoring these reports to meet specific needs, users can better track performance, identify trends, and make informed decisions that drive growth. Whether you’re a small business owner or a financial manager, mastering this capability can help streamline operations and enhance profitability. As businesses navigate an increasingly complex economic landscape, adapting financial reporting to align with unique operational goals has never been more critical. By leveraging the customizable features of QuickBooks Online, organizations can gain a competitive edge and pave the way for long-term success. For those looking to maximize their financial acumen, embracing these customizable options is a vital step forward.