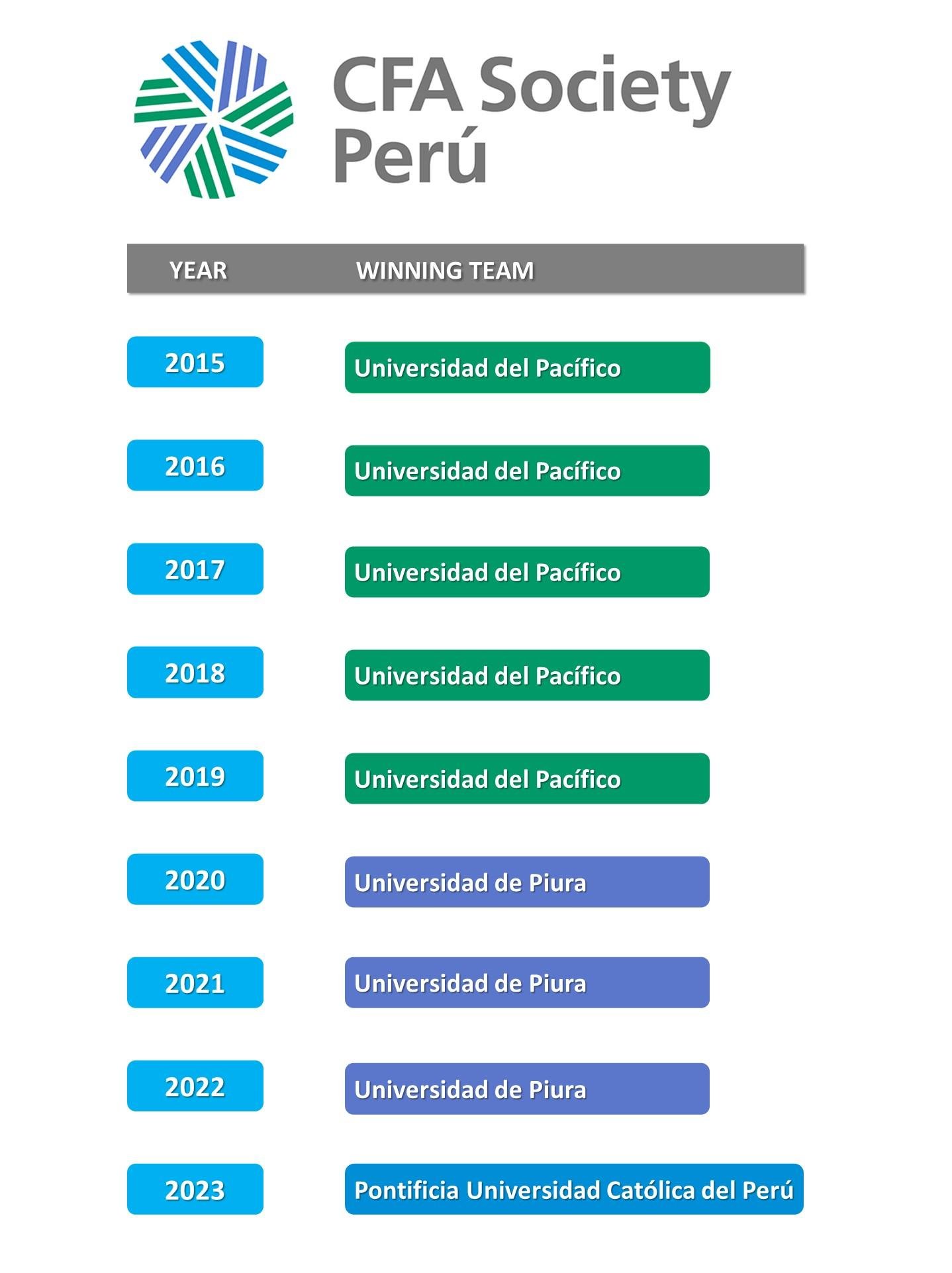

cfa research challenge winning report

In the dynamic realm of finance and investment, where analytical prowess and strategic insight are paramount, the CFA Research Challenge stands as a premier competition that tests the mettle of the brightest minds. Each year, teams of students from around the world undertake the formidable task of producing a comprehensive equity research report, aiming not only to impress seasoned industry professionals but also to gain invaluable experience in the intricacies of financial analysis. Winning this challenge is no small feat; it requires not just technical skill, but also creativity, diligence, and the ability to communicate complex ideas clearly and effectively. In this article, we delve into the essence of a winning CFA Research Challenge report—exploring the key elements that set successful submissions apart, the rigorous evaluation process, and the impact of this prestigious competition on aspiring finance professionals. Join us as we unpack the journey from initial research to triumphant presentation, uncovering the secrets behind crafting a report that can captivate judges and pave the way for future success in the world of finance.

Unveiling the Secrets of a Winning CFA Research Challenge Report

Crafting a standout CFA Research Challenge report requires not just analytical rigor, but also a compelling narrative that engages and informs the audience. A winning report often includes a clear structure that guides the reader through the analysis, making it easy to follow your thought process. Key elements to focus on include:

- Executive Summary: Summarize your findings, stress the implications, and highlight your recommendations in a concise manner.

- Robust Analysis: Present data in a clear and logical way, using graphs and charts to effectively illustrate your key points.

- Strategic Recommendations: Provide actionable strategies based on your analysis that align with the specific objectives of the organization studied.

In addition to these structural elements, attention to detail plays a vital role in setting your report apart. This includes precise data sourcing and citations to establish credibility, as well as rigorous proofreading to eliminate any errors. Engaging visuals can also enhance the report’s appeal. Consider creating a table to summarize critical financial metrics:

| Metric | Value | Year |

|---|---|---|

| Revenue Growth | 15% | 2023 |

| Net Profit Margin | 12% | 2023 |

| Return on Equity | 18% | 2023 |

Key Components of an Impactful Equity Analysis

“`html

To conduct an effective equity analysis, it is essential to incorporate several key elements that provide a comprehensive view of the stock in question. These components include:

- Financial Metrics: Examining key performance indicators such as Revenue Growth, Earnings Before Interest and Taxes (EBIT), and Net Profit Margin is critical. These metrics reflect the company’s financial health and operational efficiency.

- Market Position: Understanding the company’s competitive advantages, such as market share, brand loyalty, and barriers to entry helps in assessing its sustainability against competitors.

- Management Quality: Evaluating the experience and track record of the company’s leadership can provide insights into its strategic direction and corporate governance.

- Industry Analysis: A thorough examination of broader industry trends, regulatory impacts, and economic conditions is vital for contextualizing the company’s performance within its sector.

Moreover, to enhance the credibility and relevance of an equity analysis, incorporating qualitative elements is equally as important. These include:

- SWOT Analysis: Conducting a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis can succinctly summarize the internal and external factors affecting the company.

- Valuation Models: Applying various valuation models such as Discounted Cash Flow (DCF) and Comparable Company Analysis allows for a more nuanced understanding of a company’s intrinsic value.

- Risk Assessment: Identifying potential risks, including market volatility and operational risks, helps to alert investors to possible future challenges.

| Component | Description |

|---|---|

| Financial Metrics | Key performance indicators reflecting financial health. |

| Market Position | Competitive advantages and market share analysis. |

| Management Quality | Evaluation of the leadership team’s experience and strategy. |

| Industry Analysis | Understanding economic and regulatory impacts on the sector. |

“`

Crafting Compelling Recommendations for Stakeholders

To create recommendations that resonate with stakeholders, it is essential to align your findings with their interests and strategic goals. Start by thoroughly understanding their priorities and challenges. This sets the stage for impactful insights. Once you have this foundation, consider the following approaches:

- Tailored Solutions: Customize recommendations to address specific stakeholder concerns, emphasizing how they meet unique needs.

- Clear Metrics: Use quantifiable data to back your proposals, illustrating potential outcomes and benefits.

- Visual Aids: Incorporate charts and graphs to enhance comprehension and engagement.

Additionally, it’s crucial to present your recommendations in a structured format that promotes clarity and persuasive storytelling. A well-organized table can serve as a powerful tool:

| Recommendation | Expected Outcome | Time Frame |

|---|---|---|

| Enhance Online Presence | Increased Brand Awareness | 3-6 Months |

| Implement Customer Feedback Loops | Improved Customer Satisfaction | 1-2 Months |

| Diversify Investment Portfolio | Risk Mitigation | Ongoing |

By clearly articulating the direct benefits of your recommendations in an organized manner, stakeholders can better understand the value presented, leading to more informed decision-making.

Best Practices for Effective Presentation and Communication Techniques

To captivate your audience during a presentation, it’s essential to weave together storytelling and visual elements effectively. Framing your story allows you to create a compelling narrative that guides your listeners through the main points. Start with a strong hook and conclude with a clear call to action. To enhance understanding, utilize visual aids, such as slides, graphs, or charts. This not only helps to emphasize key points but also caters to different learning styles. Remember, engagement is vital; ask open-ended questions and encourage interaction to make your presentation more dynamic and memorable.

In addition to storytelling, strong communication techniques elevate the effectiveness of your message. Practice active listening as you engage with your audience, responding thoughtfully to their feedback and questions. Employ clear and concise language, avoiding jargon that may alienate listeners. To further streamline your delivery, rehearse with a focus on timing and body language. A well-structured presentation paired with confident nonverbal cues can significantly enhance audience retention. Consider employing techniques like pause for effect and varying your tone to maintain interest and emphasize critical information. Here’s a quick reference table of effective strategies:

| Technique | Description |

|---|---|

| Storytelling | Creates a narrative to engage and structure your content. |

| Visual Aids | Enhances understanding and retention through images and graphs. |

| Active Listening | Encourages audience interaction and responsiveness. |

| Clear Language | Avoids confusion and keeps the audience focused. |

| Body Language | Conveys confidence and attracts attention. |

Key Takeaways

the CFA Research Challenge stands as a testament to the power of collaboration, rigorous analysis, and innovative thinking in the realm of finance. The winning report not only epitomizes excellence but also serves as a benchmark for aspiring analysts seeking to make their mark in the industry. As we reflect on the journey of these bright minds—from the initiation of their research to the triumphant presentation of their findings—it’s clear that the skills honed through this competition extend far beyond the confines of the classroom. They prepare participants not just to compete, but to thrive in the ever-evolving landscape of global finance. Whether you are a seasoned finance professional or a student with dreams of influencing the financial world, the insights gleaned from the winning report can inspire and guide you on your own path to success. As we look to the future, let’s celebrate the spirit of inquiry and excellence that defines the CFA Research Challenge and continues to shape the next generation of financial leaders.