britannia equity research report

Navigating the Financial Landscape: An Insight into the Britannia Equity Research Report

In an ever-evolving market teeming with opportunities and challenges, investors and analysts are continually on the lookout for reliable insights to inform their strategies. The Britannia Equity Research Report stands out as a beacon of clarity amidst the complexities of financial data and corporate performance. With a reputation steeped in analytical rigor and comprehensive evaluations, this report serves as a vital resource for stakeholders eager to understand the intricate dynamics of Britannia Industries. From a meticulous examination of market trends to an in-depth analysis of company fundamentals, this report not only illuminates the path forward but also equips investors with the tools needed to make informed decisions. As we delve into the key findings and implications of the latest report, we invite you to explore the wealth of knowledge it offers, shedding light on one of India’s most iconic brands and its position in the competitive landscape.

Understanding Britannias Market Position and Competitive Landscape

Britannia Industries has established itself as a formidable player in the Indian market, primarily within the fast-moving consumer goods (FMCG) sector. The company focuses on a diverse portfolio, ranging from biscuits and bread to dairy products and snacks. This extensive array of offerings has allowed Britannia to cater to various consumer needs, which is vital in a rapidly evolving market. Key factors contributing to its strong market position include:

- Brand Equity: A well-recognized name synonymous with quality.

- Distribution Network: An expansive reach that ensures availability across urban and rural areas.

- Product Innovation: Continuous introduction of new flavors and health-focused products.

However, the competitive landscape is ever-changing, with several players vying for market share. Major competitors, such as Parle, ITC, and Nestlé, exert pressure through aggressive marketing strategies and innovative product lines. The industry is characterized by:

| Competitor | Strengths | Market Share (%) |

|---|---|---|

| Parle | Cost leadership, variety of snacks | 18% |

| ITC | Diversified portfolio, sustainability initiatives | 14% |

| Nestlé | Brand maturity, premium product lines | 10% |

This competitive scenario underscores the importance for Britannia to not only maintain its current market position but also to evolve continuously by adapting to consumer preferences and leveraging its strengths effectively.

Key Financial Metrics and Performance Analysis

html

Analyzing the financial performance of Britannia entails a careful review of key metrics that illustrate its operational effectiveness and market position. The company's profitability ratios provide insight into how efficiently it generates profit relative to its sales, assets, and equity. Critical metrics such as Return on Equity (ROE), Gross Profit Margin, and Operating Profit Margin can help stakeholders understand profitability trends over time. Additionally, the liquidity ratios, including the Current Ratio and Quick Ratio, highlight the company's ability to meet short-term obligations, ensuring it remains financially stable in fluctuating market conditions.

Further scrutiny of solvency ratios like the Debt-to-Equity Ratio reveals the extent to which Britannia is financed by debt and the implications for financial risk. Coupling these insights with efficiency metrics, such as Inventory Turnover and Accounts Receivable Turnover, can reveal how well the company utilizes its assets to generate revenue. To summarize these essentials in a comprehensive format, the following table outlines key metrics for quick reference:

Metric

Current Value

Industry Average

Return on Equity (ROE)

15%

12%

Current Ratio

1.5

1.2

Debt-to-Equity Ratio

0.5

0.7

Gross Profit Margin

40%

35%

Investment Insights and Strategic Recommendations

Investors looking to tap into the competitive landscape of Britannia’s market should consider implementing a multi-faceted strategy. Diversification remains key in mitigating potential risks associated with market volatility. Focus on the following areas:

- Product Innovation: Invest in R&D to keep pace with changing consumer preferences and health trends.

- Market Expansion: Identify underpenetrated regions with growth potential, particularly in emerging markets.

- Sustainability Practices: Prioritize eco-friendly initiatives that resonate with socially-conscious consumers.

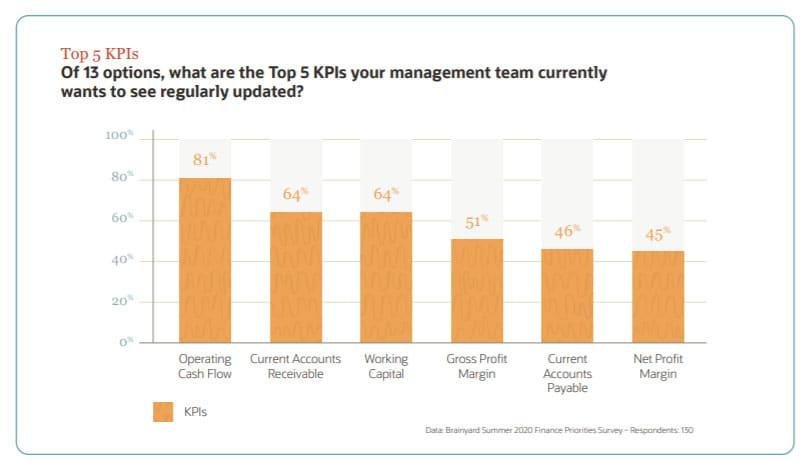

Additionally, monitoring key performance indicators (KPIs) will be essential for adjusting investment strategies. A table summarizing critical metrics is outlined below for a clearer analysis of performance:

| Metric | Current Value | Target Value | Quarterly Change |

|---|---|---|---|

| Market Share % | 12.5% | 15% | +2% |

| Net Profit Margin % | 8% | 10% | -0.5% |

| Debt-to-Equity Ratio | 0.5 | 0.4 | -0.1 |

Future Outlook: Growth Opportunities and Challenges Ahead

As Britannia Industries navigates the evolving landscape of the food industry, several growth opportunities emerge on the horizon. With a rising demand for health-oriented products, the company can leverage this trend by expanding its portfolio into organic and functional foods. Additionally, the increasing penetration of e-commerce allows Britannia to enhance its distribution channels, reaching a wider audience that values convenience and quality. The launch of innovative packaging solutions tailored for sustainability can further elevate brand loyalty among environmentally conscious consumers. Key opportunities include:

- Expansion into new markets: Targeting rural and semi-urban areas to tap into untapped consumer segments.

- Health-focused product lines: Developing low-calorie and nutrient-rich options.

- Strategic partnerships: Collaborating with local artisans and suppliers for unique offerings.

However, these growth prospects come with their own set of challenges. Competition from both established players and new entrants poses a significant risk, as market shares can rapidly shift. Additionally, fluctuating raw material prices and supply chain disruptions can impact production timelines and costs. The need for continuous innovation to keep up with changing consumer preferences adds another layer of complexity. Companies must address risks including:

- Price volatility: Accountability for sourcing raw materials efficiently.

- Consumer trends: Keeping pace with shifting demands and dietary patterns.

- Regulatory compliance: Adapting to evolving food safety and labeling requirements.

Key Takeaways

the Britannia Equity Research Report offers a comprehensive perspective on the company’s financial health and market positioning. Through meticulous analysis and insightful projections, it equips investors and stakeholders with the knowledge needed to navigate the complexities of the fast-evolving food industry. As Britannia continues to innovate and expand its product offerings, maintaining a keen eye on industry trends and consumer behaviors will be paramount. Whether you’re a seasoned investor or simply intrigued by the dynamics of the market, understanding the implications of this report can illuminate paths to informed decisions. The journey of Britannia unfolds continually, reflecting the pulse of a vibrant sector, and this report serves as a valuable companion along that journey.