moneycontrol broker research report

In the ever-evolving landscape of financial markets, making informed investment decisions can often feel like navigating a labyrinth of choices and information. Enter the Moneycontrol Broker Research Report — a beacon designed to illuminate the path for both seasoned traders and novice investors alike. This comprehensive resource merges expert analysis with actionable insights, offering a deep dive into market trends, stock performances, and sectoral movements. Whether you’re looking to optimize your portfolio or explore new investment opportunities, the Moneycontrol Broker Research Report serves as a valuable tool to demystify the complexities of the market and empower you on your financial journey. In this article, we will explore the key features of this research report, its methodology, and how it can be leveraged to make more strategic investment choices.

Understanding the Core of Moneycontrol Broker Research Reports

Delving into the essence of broker research reports reveals a treasure trove of insights for investors and traders alike. These reports provide an intricate analysis of market trends, stock performance, and sector-specific developments. The key components often highlighted in these reports include:

- Market Overview: An examination of current economic conditions, including interest rates, inflation, and geopolitical factors affecting markets.

- Stock Analysis: Detailed evaluations of individual stocks, showcasing historical performance, future projections, and valuation metrics.

- Recommendations: Expert advice on buy, sell, or hold strategies based on comprehensive research and analysis.

- Risk Assessment: Identification of potential risks associated with investments and strategies to mitigate them.

Additionally, broker research reports often encapsulate their findings in easy-to-follow formats, including charts, tables, and graphs that visually represent data trends. For example, a sample table might summarize key metrics for selected stocks, facilitating informed decision-making:

| Stock Name | Current Price | Target Price | Recommendation |

|---|---|---|---|

| ABC Corp | $150 | $175 | Buy |

| XYZ Ltd | $80 | $75 | Sell |

| MNO Inc | $120 | $130 | Hold |

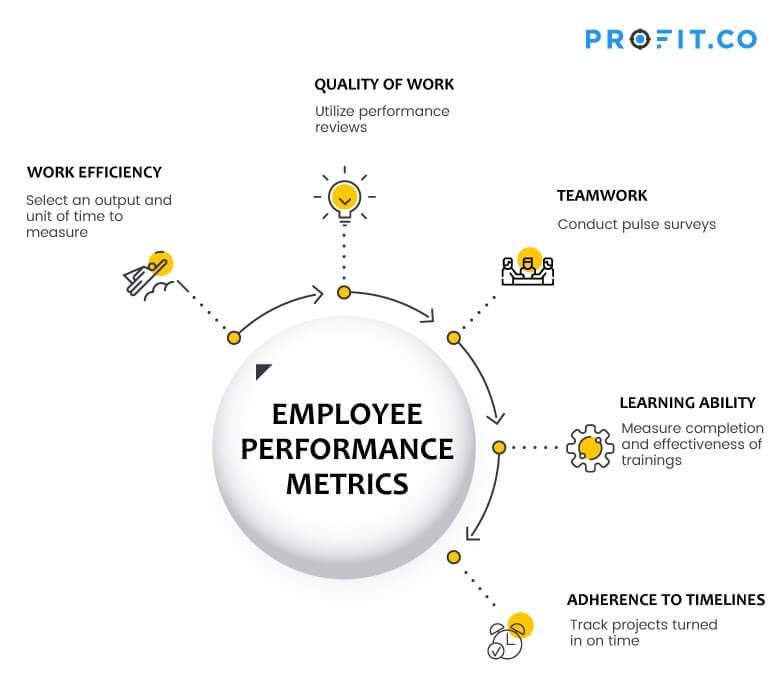

Evaluating Performance Metrics and Market Predictions

In the intricate landscape of finance, assessing performance metrics is pivotal for understanding a broker’s effectiveness and predicting market trends. Key indicators such as trade execution speed, commission costs, and customer satisfaction ratings play a critical role in evaluating a broker’s reliability. To systematically analyze these metrics, investors can utilize a range of tools and methodologies, ensuring they align with market expectations. Incorporating advanced analytics can reveal patterns that inform strategic decisions, influencing everything from trade volume to risk assessment.

Market predictions further enhance this evaluation process, serving as a guide for future investment strategies. By employing quantitative models and historical data analysis, brokers can project potential market movements. Essential elements of these predictions may include economic indicators, trading volume trends, and sentiment analysis from various market participants. Understanding how these factors intertwine can empower investors to make informed decisions, fostering a more proactive approach in their trading strategies.

Strategic Investment Insights for Maximizing Returns

In the evolving landscape of financial markets, understanding the nuances of strategic investment is crucial for deriving optimal returns. Savvy investors are leveraging comprehensive broker research reports to unearth potential opportunities and mitigate risks. By focusing on fundamental analyses, these reports shed light on critical metrics such as earnings growth, dividend yields, and market trends. Furthermore, they often include comparative analyses and sector insights that assist in making informed investment choices, thus enabling clients to craft well-rounded portfolios that are aligned with their financial goals.

To facilitate informed decision-making, consider employing a structured approach to reviewing broker insights. Key factors to assess may include:

- Market Positioning: Identifying leading firms and their innovation capacities.

- Risk Assessment: Evaluating volatility and potential downturns in various sectors.

- Performance Metrics: Analyzing ROI expectations versus historical data.

This method not only streamlines your investment strategy but also enhances the likelihood of achieving superior returns. By aggregating insights from these reports, investors can create a resilient framework that adapts to market changes while focusing on strategic growth opportunities.

| Investment Type | Expected ROI | Risk Level |

|---|---|---|

| Equities | 8-12% | Medium-High |

| Bonds | 3-5% | Low-Medium |

| Real Estate | 6-10% | Medium |

| Mutual Funds | 5-9% | Medium |

Navigating Market Risks: Recommendations for Savvy Investors

In the ever-evolving financial landscape, investors face a myriad of market risks that require astute navigation. Understanding these risks is fundamental to safeguarding your investments. It’s essential to develop a robust risk management strategy that encompasses both macroeconomic factors and individual asset classes. Savvy investors should consider the following approaches:

- Diversification: Spread investments across various sectors and asset classes to mitigate potential losses.

- Research: Keep abreast of market trends and analyses to make informed decisions.

- Risk Assessment: Regularly evaluate the risk profile of your portfolio and adjust accordingly.

Additionally, maintaining a keen awareness of external factors can significantly impact investment decisions. Key economic indicators can provide critical insights into market movements:

| Indicator | Importance |

|---|---|

| Interest Rates | Influences borrowing costs and investor sentiment. |

| Inflation Rates | Affects purchasing power and corporate profits. |

| Employment Data | Reflects economic health and consumer spending patterns. |

By keeping these strategies and indicators in mind, investors can enhance their resilience against market fluctuations and seize opportunities when they arise.

Key Takeaways

the Moneycontrol broker research report stands as a pivotal asset for investors navigating the complex world of finance. By synthesizing expert insights and comprehensive data, this resource empowers users to make informed decisions tailored to their individual investment strategies. As the financial landscape continues to evolve, staying attuned to dynamic market trends and thorough analyses becomes essential. Whether you’re a seasoned trader or a novice exploring your options, the Moneycontrol broker research report provides a compass, guiding you toward potential opportunities and helping you mitigate risks. Embrace the knowledge at your fingertips, and let it illuminate your path to financial success.