motilal oswal latest equity research report

In the ever-evolving landscape of finance and investment, staying informed is crucial for making sound decisions. Recent insights from the Motilal Oswal latest equity research report illuminate emerging trends and investment opportunities that could shape the market dynamics in the coming months. With a reputation for meticulous analysis and foresight, Motilal Oswal has once again provided a comprehensive examination of various sectors, offering both seasoned investors and newcomers a clear perspective on where to direct their attention. In this article, we will delve into the key findings of the report, exploring the underlying factors driving market movements and the potential implications for equity investors. Whether you’re looking to refine your portfolio or seeking guidance on navigating the complexities of the stock market, the insights from Motilal Oswal serve as a valuable compass in today’s financial environment.

Unveiling Growth Trends in the Market Landscape

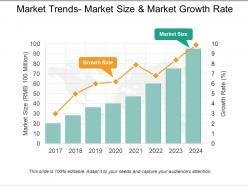

As the economic landscape continues to evolve, understanding the latest growth trends is paramount for investors. The recent findings from Motilal Oswal’s equity research report shed light on several key sectors poised for significant expansion. Among these sectors, technology, consumer goods, and healthcare stand out, reflecting robust demand and adaptation to changing consumer behaviors. The potential for innovation and market penetration makes these areas attractive for portfolio diversification.

The report further delineates strategic insights into market performance indicators, enabling investors to make informed decisions. For instance, a comparative analysis of sector growth rates over the last fiscal year reveals staggering potential:

| Sector | Growth Rate (%) | Key Drivers |

|---|---|---|

| Technology | 15.2 | A.I. Developments, Cloud Adoption |

| Consumer Goods | 10.7 | Shifts to E-commerce, Sustainability Trends |

| Healthcare | 12.1 | Telemedicine, Biotech Innovations |

These insights not only indicate where to invest but also hint at underlying market dynamics that could shape future investment strategies. Emphasizing the significance of continuous research and flexibility, the report encourages a proactive approach to adapting to emerging trends.

Key Sectors Driving Investment Opportunities

html

The current landscape of investment opportunities has been significantly influenced by several key sectors poised for growth. Technology remains at the forefront, continuously evolving with advancements in artificial intelligence, cloud computing, and cybersecurity. Investors are gravitating towards companies that demonstrate robust innovation and scalability. In addition, the renewable energy sector is rapidly gaining traction, driven by global shifts towards sustainability and environmental consciousness. Investors are increasingly focusing on solar, wind, and electric vehicle technologies that promise long-term growth and alignment with changing consumer preferences.

Another vital area is healthcare, where advancements in biotechnology and telemedicine are creating exciting investment prospects. The aging population and increased healthcare demand are pushing innovations, particularly in pharmaceuticals and improved healthcare delivery systems. Furthermore, the real estate sector, particularly in the multi-family housing and logistics sub-sectors, is attracting attention due to urbanization trends and the growing need for last-mile delivery solutions. This diversification across sectors highlights the evolving nature of investment strategies, necessitating a well-rounded approach to capture emerging opportunities.

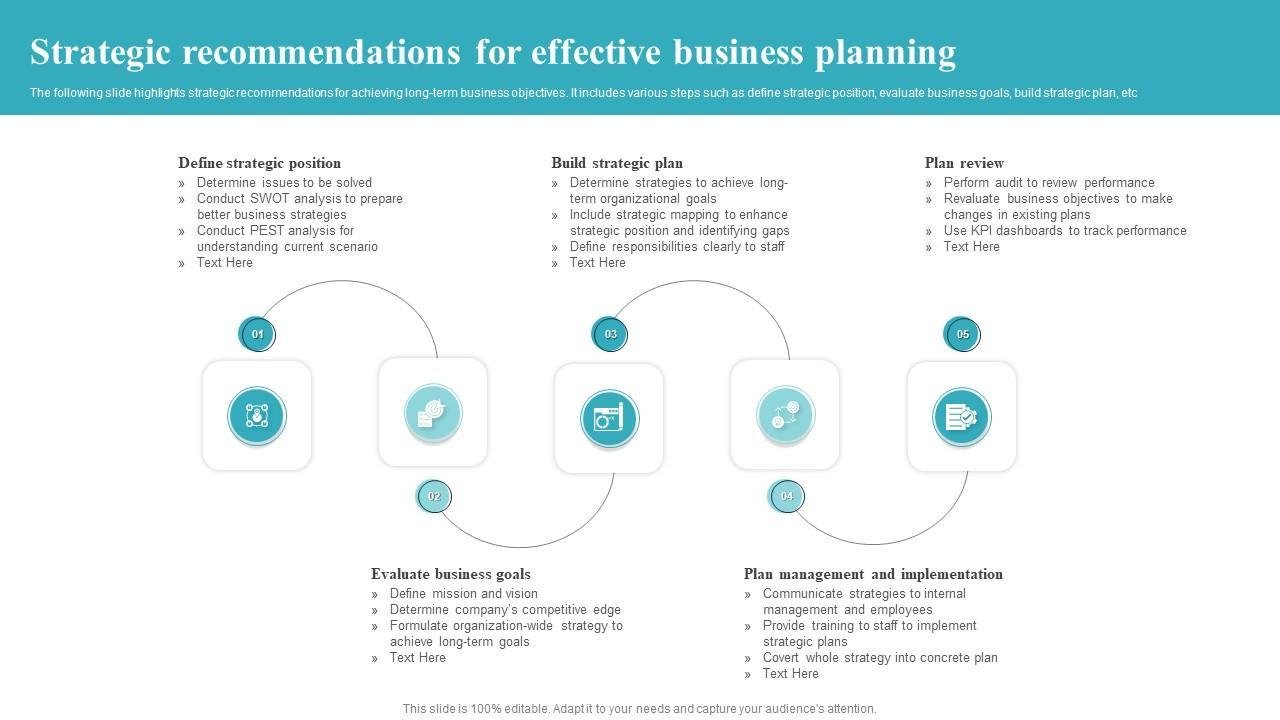

Strategic Recommendations for Resilient Portfolios

In navigating the complexities of today’s financial landscape, investors are encouraged to diversify their holdings across various sectors. Focusing on sectors that demonstrate resilience in times of economic uncertainty can provide a buffer against volatility. Consider incorporating assets that have historically shown robust performance, such as:

- Utilities: Stable cash flows and demand make this sector a safe haven.

- Consumer staples: Essential goods maintain consistent sales even during downturns.

- Healthcare: With an aging population, this sector remains a crucial part of any portfolio.

Moreover, employing a strategy that blends active and passive investment approaches can enhance overall returns while managing risk. Emphasizing low-cost index funds combined with selective high-quality equities ensures that investors capture market growth while also safeguarding capital. When evaluating potential additions to your portfolio, consider:

| Criteria | Importance |

|---|---|

| Market Position: | A strong position indicates resilience against market fluctuations. |

| Financial Health: | Robust balance sheets signal stability and growth potential. |

| Dividend History: | Consistent dividends indicate reliability and investor confidence. |

Navigating Risks: Insights from the Latest Equity Analysis

The latest equity analysis by Motilal Oswal reveals a complex tapestry of market dynamics that investors must navigate with caution. In a landscape marked by volatility, understanding the underlying risks is crucial for informed decision-making. Some of the key insights from the report include:

- Market Sentiment: Fluctuating investor sentiments can lead to abrupt shifts in stock performance, making emotional restraint a vital part of investment strategy.

- Sector Performance: Certain sectors are showing resilience despite broader market challenges. Identifying these sectors can offer strategic opportunities.

- Global Influences: International events and economic policies are significantly impacting market trends, necessitating a global perspective in investment analysis.

Furthermore, the report highlights the importance of risk management techniques that could shield investors during turbulent times. Implementing a diversified portfolio can mitigate risks associated with sector or asset concentration. To visualize the risk landscape, consider the following table:

| Investment Strategy | Risk Level | Suggested Action |

|---|---|---|

| Diversification | Moderate | Continue allocating across different sectors. |

| Growth Stocks | High | Monitor closely; be ready to adjust positions. |

| Value Investing | Low | Consider increasing exposure for stability. |

By incorporating these insights, investors can enhance their strategies, positioning themselves to effectively manage risks while pursuing growth opportunities in an ever-evolving market environment.

The Way Forward

the latest equity research report from Motilal Oswal provides a comprehensive analysis of market trends, investment opportunities, and potential risks that investors should consider. The insights drawn from in-depth data and expert evaluations pave the way for informed decision-making in an ever-evolving financial landscape. As investors navigate the complexities of the stock market, this report serves as a valuable resource, equipping them with the knowledge necessary to strategize effectively. Whether you are a seasoned investor or just beginning your journey, keeping abreast of such research will undoubtedly enhance your ability to make prudent investment choices. As we look ahead, the dynamic nature of the market reminds us that continuous learning and adaptability are key to successful investing.