goldman sachs equity research report

Goldman Sachs has long been a pivotal player in the global financial landscape, recognized not only for its investment banking prowess but also for its insightful equity research. As a premier financial institution, its equity research reports offer invaluable analysis and forecasts that guide investors and shape market perceptions. In this article, we will delve into the intricacies of Goldman Sachs’ equity research reports, exploring their methodologies, key findings, and the implications they hold for both institutional and retail investors. By understanding the depth and reach of their reports, we can appreciate how Goldman Sachs continues to influence investment strategies and market trends across various sectors.

Navigating Market Trends: Key Findings from Goldman Sachs Equity Research

“`html

In the ever-evolving landscape of equity markets, Goldman Sachs consistently delivers insights that help investors navigate volatility and capitalize on emerging trends. Recent equity research highlights several pivotal market dynamics that are shaping investment strategies. Key findings include:

- Shifts in Consumer Behavior: There’s a noticeable trend towards sustainability, driving demand for companies with robust ESG (Environmental, Social, and Governance) profiles.

- Sector Rotation: Analysts emphasize the importance of strategic sector rotation, particularly from growth to value stocks, as interest rates fluctuate.

- Global Economic Indicators: Monitoring global economic indicators is crucial, as geopolitical tensions and inflation impacts are affecting market sentiment.

Furthermore, Goldman Sachs advocates for a data-driven approach to investment, utilizing advanced analytics to identify key opportunities within the market. Their research has uncovered several categories with high potential, including:

| Sector | Growth Potential |

|---|---|

| Technology | High |

| Healthcare | Moderate |

| Consumer Staples | Stable |

Engaging with these insights enables investors to not only withstand market fluctuations but also to align their portfolios with long-term growth trajectories.

“`

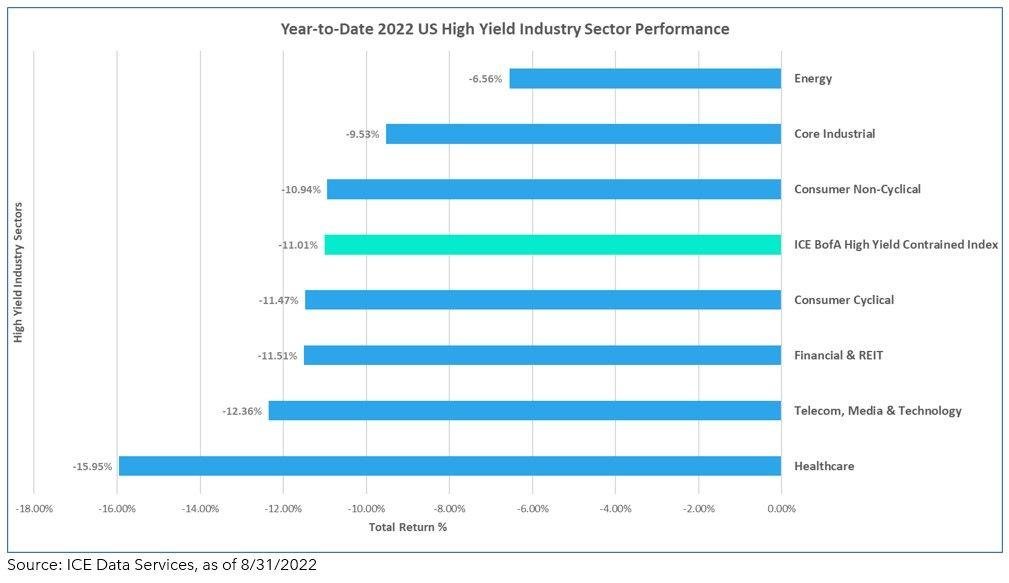

Sector Spotlight: High-Performing Industries and Investment Opportunities

In the evolving landscape of global markets, certain industries have emerged as powerful engines of growth, showcasing resilience and innovation. Technology, with its rapid advancements in artificial intelligence and cloud computing, continues to attract significant investment. Furthermore, the renewable energy sector is gaining momentum, driven by increasing regulatory support and societal demand for sustainable practices. Investors should consider focusing on companies that lead in these domains, as they represent not just immediate potential but also long-term sustainability.

Notably, the healthcare sector remains robust, particularly with the expansion of telemedicine and biopharmaceuticals. As consumer preferences shift and technology integrates further into patient care, innovative firms are capitalizing on this trend. Below is a brief overview of key industries with promising investment avenues:

| Industry | Growth Drivers | Investment Potential |

|---|---|---|

| Technology | AI, Cloud Services | High |

| Renewable Energy | Sustainability Initiatives | Moderate to High |

| Healthcare | Telemedicine, Biotech Innovations | High |

Strategic Recommendations: Optimizing Portfolios for Future Growth

As companies navigate an evolving market landscape, it is imperative to adopt a multi-faceted approach to portfolio optimization. Investors should focus on diversification across sectors to mitigate risks associated with market fluctuations while capitalizing on emerging trends. Key strategies to consider include:

- Investing in Sustainability: Allocate resources to companies prioritizing environmental, social, and governance (ESG) factors to align with global sustainability efforts.

- Embracing Technology: Identify firms leveraging technological advancements to improve efficiency and drive innovation.

- Global Exposure: Diversify geographically to tap into high-growth markets beyond domestic borders.

In addition, an emphasis on data analytics offers a robust framework for informed decision-making. Utilizing predictive analytics can provide insights into market trends and aid in anticipating shifts, thereby enhancing long-term growth potential. Here are some best practices for applying data analytics in portfolio management:

- Performance Tracking: Regularly assess the performance of portfolio holdings against benchmarks.

- Scenario Analysis: Employ various market scenarios to evaluate potential risks and returns.

- Market Sentiment Analysis: Leverage tools to gauge market sentiment and adjust strategies accordingly.

Risk Assessment: Understanding Market Volatility and Mitigation Strategies

“`html

Understanding the complexities of market volatility is crucial for investors aiming to navigate an ever-changing economic landscape. Market fluctuations can arise from various factors, including economic indicators, geopolitical events, and shifts in investor sentiment. To effectively assess these risks, it is essential to identify potential market hazards that could impact investment performance. Key components to consider in risk assessment include:

- Market Trends: Monitoring changes in economic data and market sentiment.

- Sector Analysis: Evaluating specific industries that may react differently to economic changes.

- Global Influences: Considering international events that could affect domestic markets.

Mitigation strategies play a vital role in managing the risks associated with market volatility. Investors should adopt a proactive approach, employing a range of strategies to shield their portfolios from potential downturns. Effective methods may include:

- Diversification: Spreading investments across different asset classes to minimize risk.

- Hedging: Utilizing financial instruments like options and futures to protect against losses.

- Regular Monitoring: Keeping a close watch on market developments to adjust strategies as needed.

“`

Closing Remarks

the Goldman Sachs Equity Research report serves as a vital compass for investors navigating the complexities of the financial landscape. With its rigorous analysis and insightful forecasts, it offers a comprehensive overview of market trends and stock performances, empowering stakeholders to make informed decisions. As we look to the future, these insights not only illuminate potential investment opportunities but also reflect Goldman Sachs’ commitment to understanding the ever-evolving dynamics of the economy. Whether you are a seasoned investor or just beginning your financial journey, the foundations laid by such research are invaluable in sculpting strategies that resonate with both current market conditions and long-term growth objectives. Remember, in the world of stocks, knowledge is your most potent ally.